READ OUR PUBLICATIONS

We send monthly newsletters to our clients, colleagues, and interested parties.

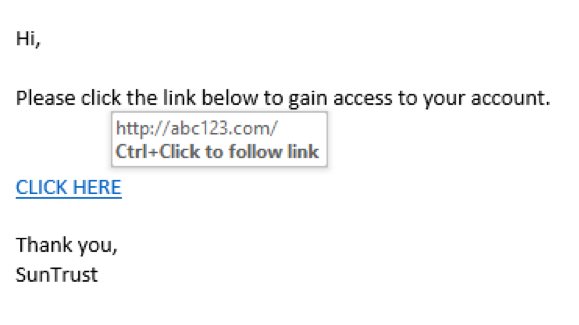

Indentity Theft

Most people have been, or know someone who has been, affected by identity theft. It happens to those in their 20’s, those in their 90’s, and to all ages in between. According to the Federal Trade Commission, identity theft occurs when someone uses personally identifying information (PII) without...

Notes from the Investment Team

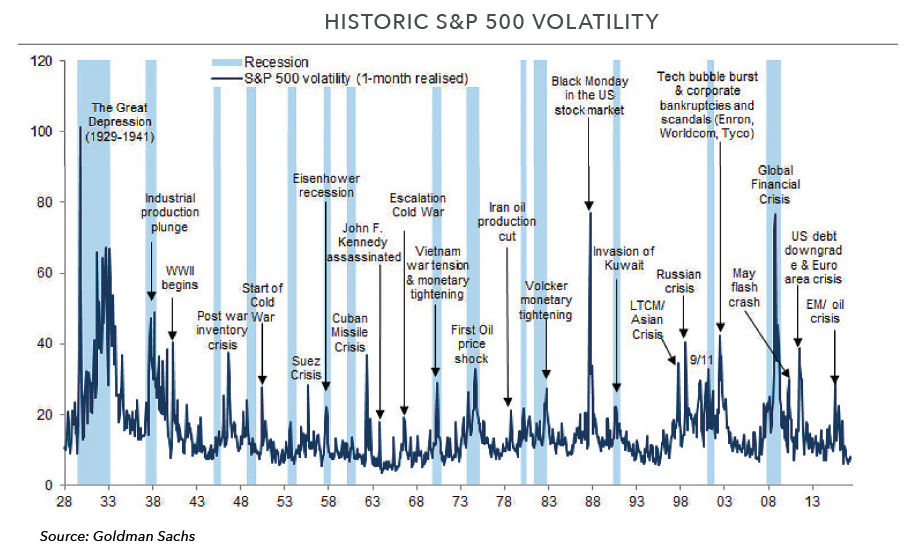

2017 was another banner year for investors. The total return (inclusive of dividends) for the S&P 500 was a gain of 22%. There were not any meaningful hiccups along the way; as shown in the chart below, the index posted positive returns in every single month of 2017. International stocks fared even...

Estate Planning For Life!

Estate planning is really “transfer planning.” It is an ongoing exercise of planning how you accumulate, conserve, and distribute your assets during life, at death, and beyond. There are both financial and non-financial reasons to plan. These range from minimizing income and estate taxes,...

Investment Approach Revisited

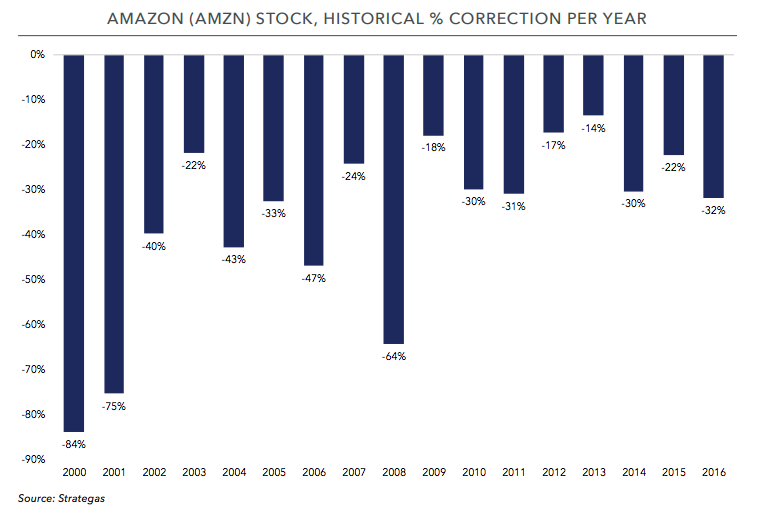

The S&P 500 continued its march higher in the third quarter and has now increased by 14% (including dividends) in 2017. International markets have reported even better results, with the MSCI World index (ex-U.S.) climbing 21% over the same period.

All-Weather Portfolio Construction

It seems that there has been an increase in severe weather these days including floods, fire, and wind. In Savannah, we suffered a direct hit from Hurricane Matthew last year and endured a mandatory evacuation this year due to Hurricane Irma. Hurricanes are a constant threat during the summer and...

Investment Maxims

I attended an investment conference recently and one of the speakers was Stephen Friedman, former Chairman of Goldman Sachs. During his fireside chat, he mentioned that when it comes to investing, he follows some basic rules of risk management. He said that these rules were universal truths that...

Summer Reading

As part of our job as investment managers, we read numerous shareholder letters every year. Occasionally, these letters offer a unique perspective or insight that renews our enthusiasm for how we think about businesses and the art of long-term investing. The most recent letter from Amazon CEO Jeff...

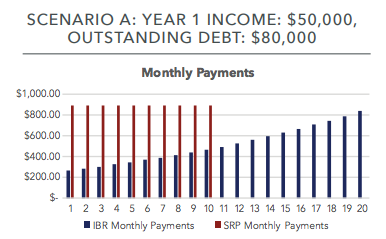

The Graduates’ Trillion Dollar Problem

Over the past few decades, student debt has transformed from a tool for accessing higher education to a significant obstacle preventing young people from accumulating wealth and saving towards retirement. According to a February 2017 report published by the Federal Reserve Bank of New York,...

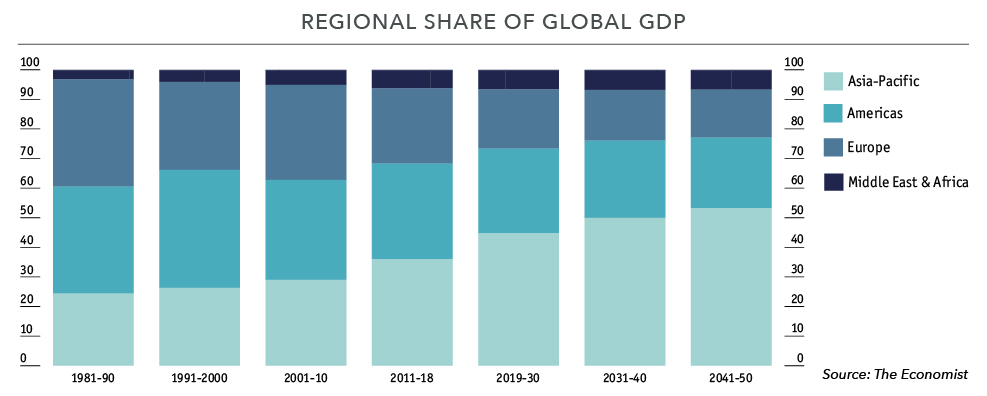

How Investing Transformed Over the Century

I recently read a book on the sinking of the Lusitania in 1915. The author thoroughly details the lives of some of the affluent passengers who were aboard the luxury liner’s final voyage. As I was learning about these “high net worth” people who lived one hundred years ago, I kept wondering about...

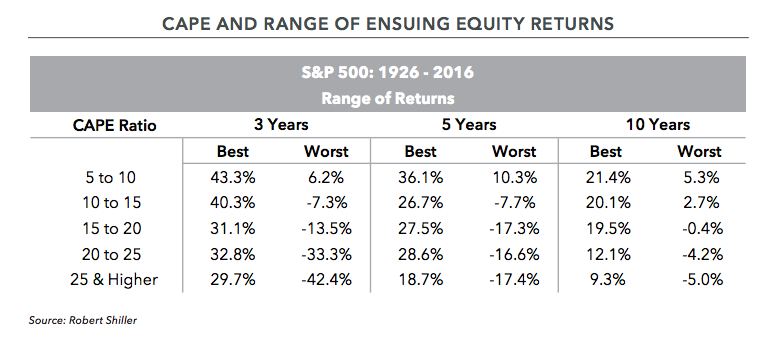

Where We Are in the Cycle

In the fourth-quarter newsletter, we discussed how we think about long-term equity return expectations. The purpose of the article was to explain how fundamental returns (driven by earnings growth) and speculative returns (driven by changes in valuation) collectively impact market prices. While...