READ OUR PUBLICATIONS

We send monthly newsletters to our clients, colleagues, and interested parties.

The Countdown to Retirement: 7 Smart Ways to Get Ready

Most people become even more focused on planning and saving as they near retirement age. The most common questions we hear people ask is, “Will I have enough money?” followed closely by, “When can I retire?” But what about high earners who know they’ll have enough money for their golden years? Is...

Investing in Continuing Education

The Fiduciary Group is proud to announce that Shanon Royal has obtained her IACCP® compliance designation. Successful completion of the certification program demonstrates commitment to professional development of the knowledge, skills, and best practices required in administering the firm’s...

The 9 Must-Have Tips for Picking a New 401(k) Plan

Are you unhappy with your existing 401(k) provider and want a better option for your employees? Perhaps you’re wondering if there are better investment options out there — or if your 401(k) fees are too high. Maybe you’ve even found yourself dealing with the fallout from a poorly administered plan,...

Planning for the Trip of a Lifetime

I recently traveled abroad and while I was preparing for the trip, I tried to anticipate the problems that travelers might encounter. Properly preparing for a trip means planning for contingencies and emergencies. We made sure to double and triple check that we had the necessary clothing, our...

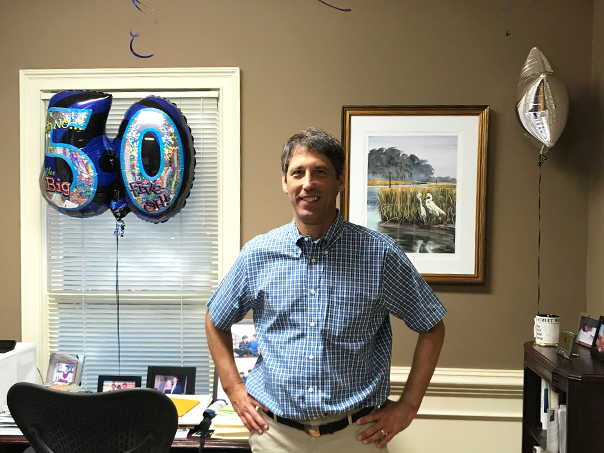

Oh No! The Big 5-0

Joel Goodman, Chief Investment Officer of The Fiduciary Group, celebrated his 50th birthday on September 12th. TFG celebrated this big milestone by decorating Joel’s office with an embarrassing amount of balloons and by serving up a birthday breakfast for the whole team to enjoy. There was plenty...

Life Insurance–Too Little or Too Much?

Life insurance is a risk management tool for both personal and business risks. In the event of the premature death of an income earner or parent, life insurance can provide tax-free cash to cover immediate expenses as well as ongoing financial support for the family.

Managing Financially After Losing A Spouse

Grappling with the loss of a loved one is the most difficult time in one’s life. Often, after years of working with an affluent couple, we find ourselves guiding the surviving spouse through the financial aspects of this major life change. Generally, it’s the husband who passes first, so quite...

Choosing A Smart Investment Strategy

If you’ve ever looked at a graph of stock market returns, you might notice the similarities with an EKG. Lots of ups and downs. But overall, the trend is up. Over the long term, the stock market has delivered compounded annual rates of return of 8-10% per year. In order to achieve the long-term...

The Schwartzburt Family Grows!

Carey joined The Fiduciary Group in 2008. Since then, the TFG Team has had the pleasure of watching her marry her husband, Joseph Schwartzburt, and have three beautiful children. The most recent addition to their family is Piper Joan who was born August 4th at 11:12am weighing seven pounds and one...

Major Life Events

Being the helpless romantic and nerd that I am, I proposed to Lauren on Tax Day 2017. We grew up an hour apart in New Hampshire. We both attended UNH and met through mutual friends. When we graduated, Lauren pursued her career in nursing while I joined a startup fintech company. Since then, we’ve...