Category: investing

Not Reaching for Yield

At the 2013 Berkshire Hathaway meeting, a shareholder asked Charlie Munger for his thoughts on Federal Reserve policy and interest rates. Here’s what he had to say: “Well, I strongly suspect that interest rates aren’t going to stay this low for extended periods. But, as I pointed out, practically...

Choosing A Smart Investment Strategy

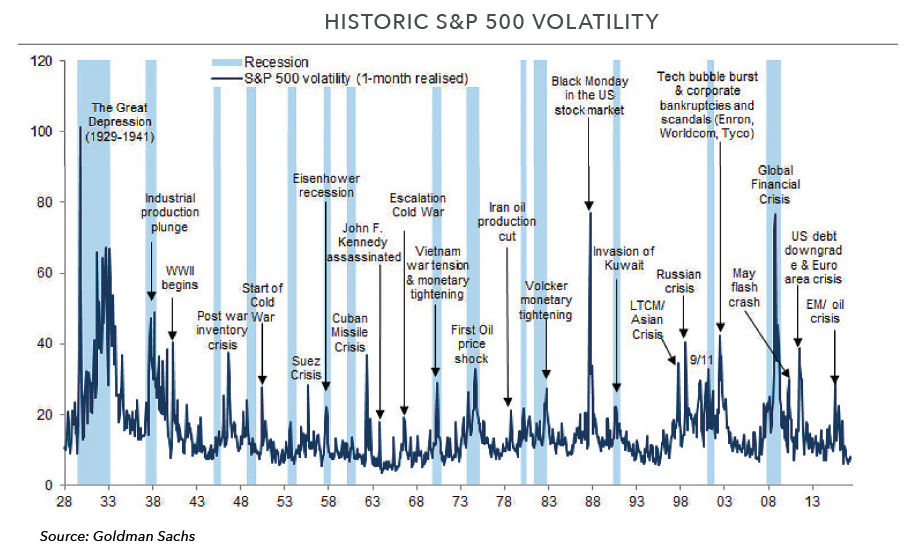

If you’ve ever looked at a graph of stock market returns, you might notice the similarities with an EKG. Lots of ups and downs. But overall, the trend is up. Over the long term, the stock market has delivered compounded annual rates of return of 8-10% per year. In order to achieve the long-term...

The Path to Value Realization

For many years, we’ve heard market prognosticators proclaim that the current bull market is nearing its fateful end. Between the Euro crisis, the U.S. debt downgrade, concerns about China, Brexit, the “taper tantrum,” and now the threat of an expanding trade war, they have offered plenty of reasons...

The Impact of Inflation

From the end of 2017 through April, inflation has increased from +2.1% to +2.5% (using CPI as a proxy). Over the same period, the yield on ten-year Treasury bonds has risen from 2.4% to 3.0%. These moves have led market participants to question if a change in the status quo is underway. Let’s...

Berkshire Trip 2018

In early May, I attended the Berkshire Hathaway shareholder meeting in Omaha, Nebraska. The event, dubbed “Woodstock for Capitalists,” attracted more than 40,000 attendees from around the world.

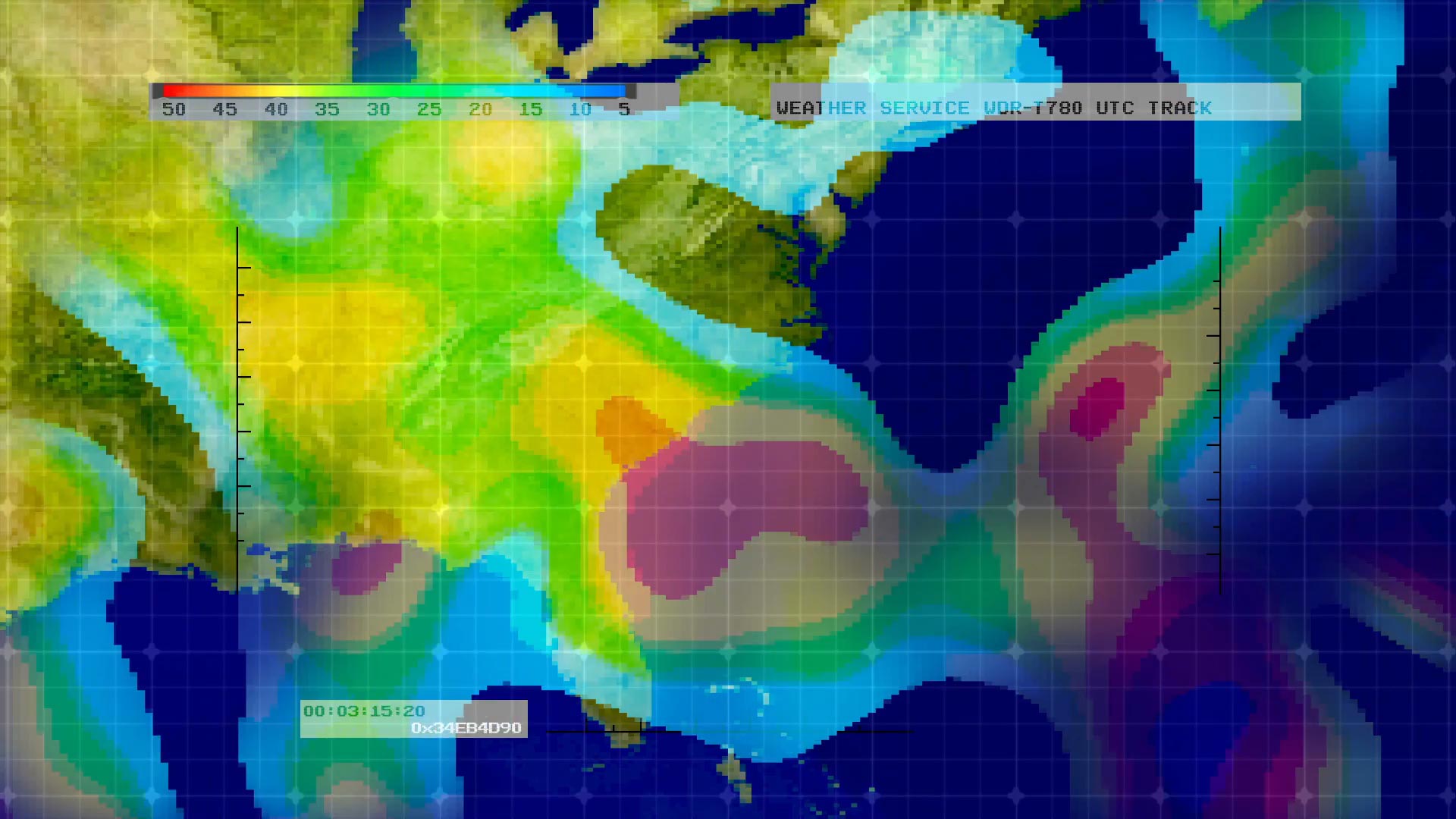

All-Weather Portfolio Construction

It seems that there has been an increase in severe weather these days including floods, fire, and wind. In Savannah, we suffered a direct hit from Hurricane Matthew last year and endured a mandatory evacuation this year due to Hurricane Irma. Hurricanes are a constant threat during the summer and...

An Antidote to Volatility

“Antidote”: Something that works against an unwanted condition to make it better.

Investment Approach Revisited

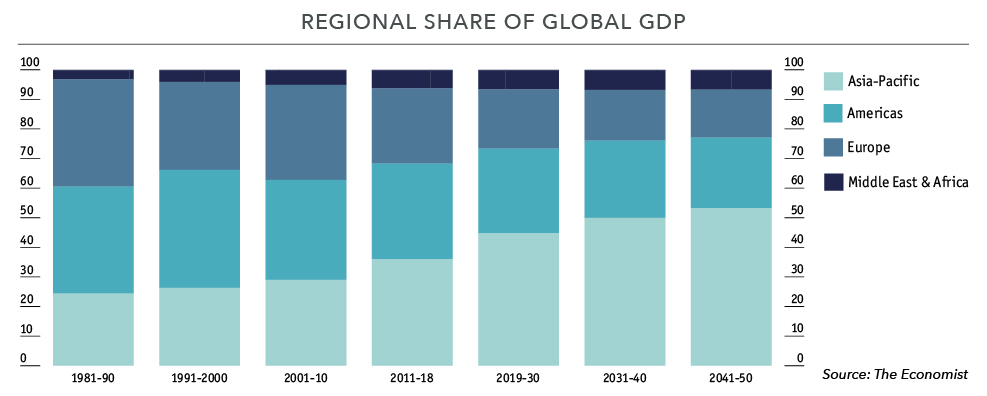

The S&P 500 continued its march higher in the third quarter and has now increased by 14% (including dividends) in 2017. International markets have reported even better results, with the MSCI World index (ex-U.S.) climbing 21% over the same period.

All-Weather Portfolio Construction

It seems that there has been an increase in severe weather these days including floods, fire, and wind. In Savannah, we suffered a direct hit from Hurricane Matthew last year and endured a mandatory evacuation this year due to Hurricane Irma. Hurricanes are a constant threat during the summer and...

Investment Maxims

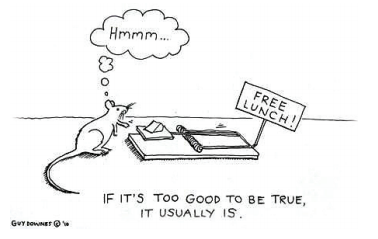

I attended an investment conference recently and one of the speakers was Stephen Friedman, former Chairman of Goldman Sachs. During his fireside chat, he mentioned that when it comes to investing, he follows some basic rules of risk management. He said that these rules were universal truths that...