Category: investing

Speculating During the Pandemic

At a time when casinos around the country are temporarily closed due to COVID-19, Americans have found a new avenue for wagering: short-term trading in the stock market. In addition to stay at home orders, there have also been technological improvements that enable anytime access to trading...

Survivorship Planning Checklist

In many families, one partner takes a more active role in handling the finances than the other. Often, this division of labor stems from fear, time pressure or lack of interest. Regardless of the root cause, having one spouse exclusively handling family finances can put the other partner in a...

Planning for Retirement in the COVID-19 Age

This article was originally published within the Savannah Morning News, found HERE.

Planning Amid Uncertainty

In times of heightened volatility and uncertainty, it’s helpful to revisit the fundamental question of why we plan and invest in the first place. As the COVID-19 pandemic continues to unfold, we will continue to see significant and wide-ranging implications on many aspects of our daily lives,...

Traditional vs. Roth IRA: Which Option is Best for You?

You’ve been working hard and earning income for years, hopefully saving a portion of your earnings for retirement. With most pensions having gone away, retirement savings accounts like an Individual Retirement Account (IRA) are going to be your safeguard or reserve to generate retirement income....

Understanding the Benefits and Risks of Bonds

Especially in times of significant stock market volatility, bonds have an important place in a balanced investment portfolio. The income that bonds generate coupled with their relatively low-price volatility can help mitigate overall portfolio risk. Unlike stocks, which provide equity interest in a...

Navigating Uncertainty and Volatility

We’re currently in the midst of a period of heightened uncertainty, volatility, and panic due to the COVID-19 (coronavirus) pandemic. Clients are justifiably worried.

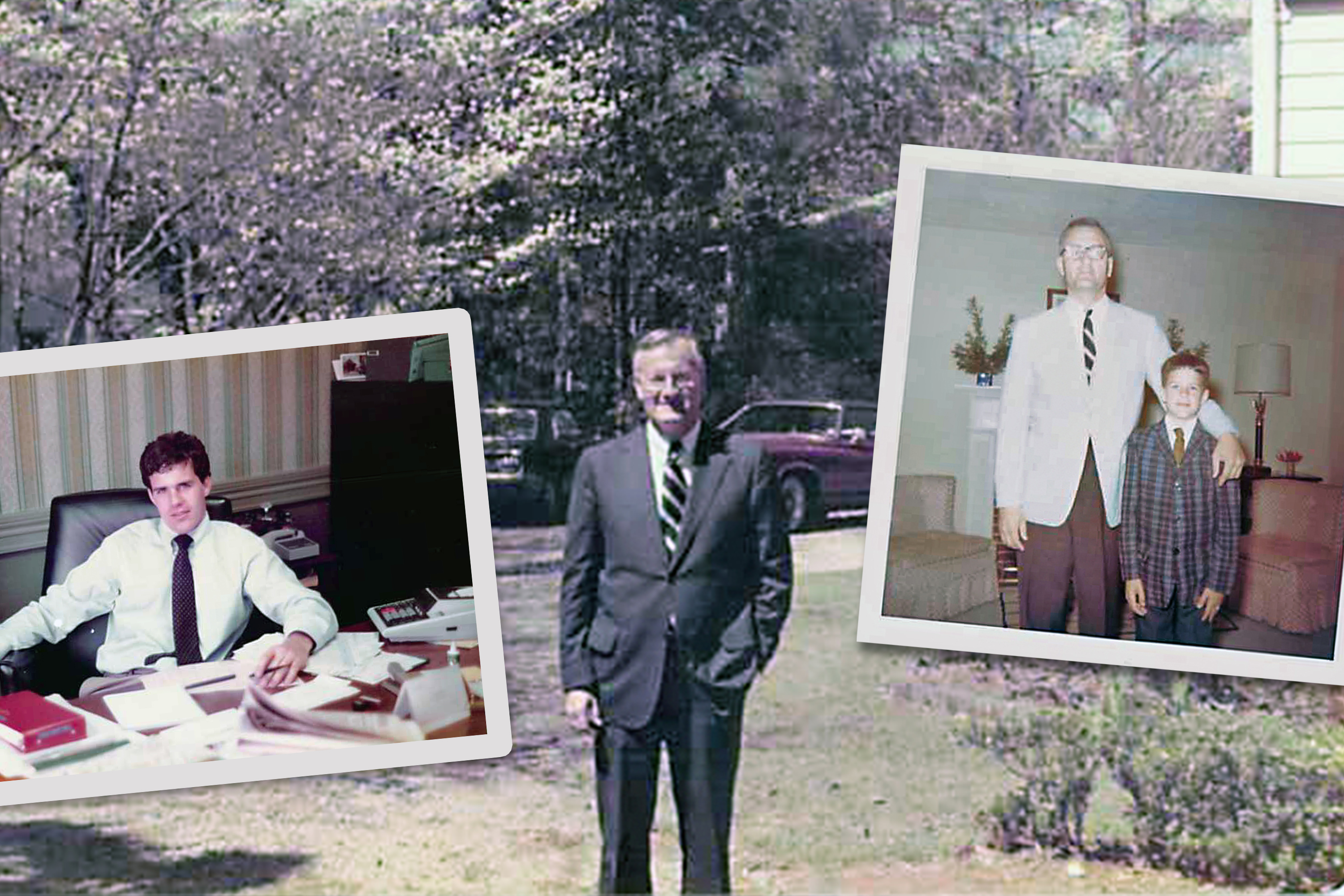

The Beginnings of The Fiduciary Group: 1970 – 2000

Lee Butler with his son Malcolm in the 1960s. The beginning of The Fiduciary Group dates back to the summer of 1969. I was the Vice President and manager of the trust department of a major Savannah bank. Banking was in turmoil in 1969, including my employer. Under the management at the time, the...

Understanding SECURE Act Changes

Each new calendar year brings about changes in our savings and retirement planning efforts, and 2020 is no exception. With the December 2019 signing of the Setting Every Community Up for Retirement Enhancement (SECURE) Act, Congress set out “to make significant progress in fixing our nation’s...

What to Focus on When Investing for the Future

As we begin a New Year and a new decade, many financial experts are polishing their financial “crystal balls” in an attempt to predict what the market will – or won’t – do in 2020 and beyond. The reality is that no one really knows how the market will perform from day to day, week to week or even...