CONSERVE. PLAN. GROW.®

At the 2013 Berkshire Hathaway meeting, a shareholder asked Charlie Munger for his thoughts on Federal Reserve policy and interest rates. Here’s what he had to say:

“Well, I strongly suspect that interest rates aren’t going to stay this low for extended periods. But, as I pointed out, practically everybody has been very surprised by what’s happened, because what’s happened would’ve seemed impossible to practically all intelligent people not very long ago.”

The past decade has presented savers seeking ways to generate income with some difficult choices. Up until recently, a one-year CD yielded a paltry 0.5%, a far cry from what was previously considered “normal”. This development required savers to either accept lower rates or to chase returns by accepting higher levels of risk. The problem with moving out on the risk curve is that it materially increases the chance of losing principal – a non starter for many retirees. As a result, the asset allocation decision was mostly about making the least bad choice.

The Fiduciary Group has been steadfast in our approach to fixed income. We view the asset class as a source of capital preservation, as well as a source of diversification against equity exposure (particularly during periods of market volatility). We are far more comfortable purchasing high quality bonds than chasing yield. In recent years, we believed that the compensation we were being offered to accept credit or interest rate risk has been inadequate. For that reason, we’ve stuck with high-quality bonds with relatively short durations.

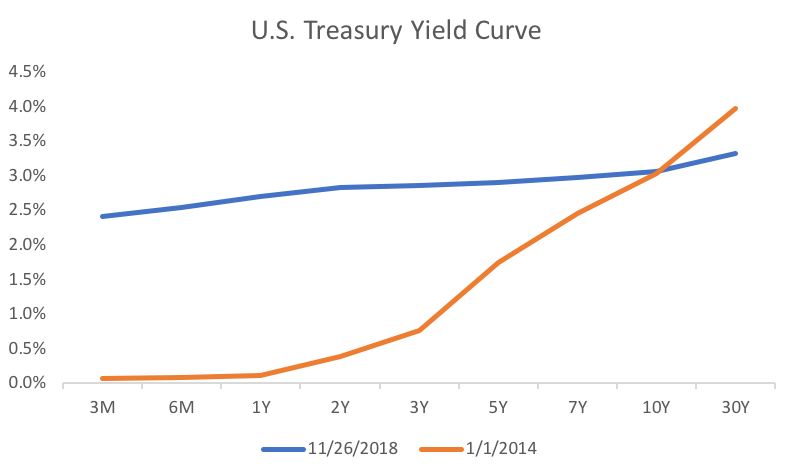

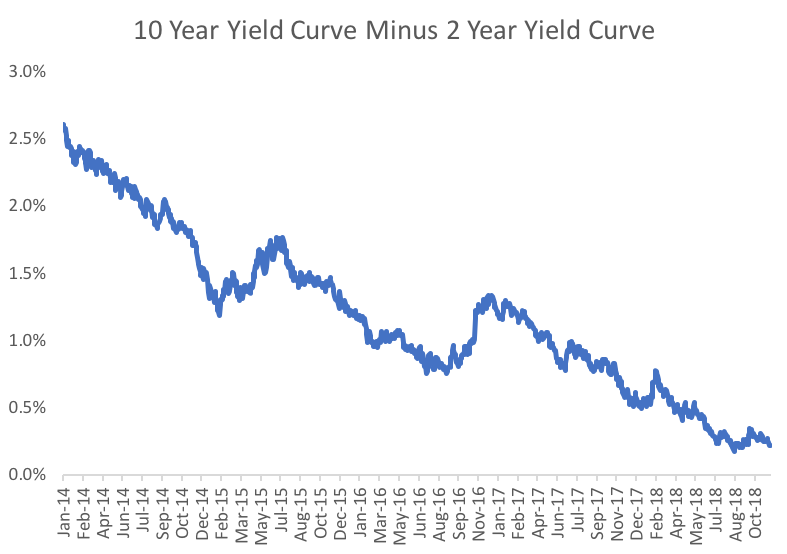

The opportunity set has started to change in recent quarters as short-term interest rates have marched higher. As you can see in the figure 1 below, the shape of the U.S. Treasury Yield Curve has dramatically shifted over the past five years. A 3-month T-Bill is now paying 2.36% as opposed to one or two basis points (0.01% – 0.02%) five years ago. We are now able to find various fixed income securities with expected returns of 3-4% per annum without enduring significant exposure to interest rate or credit risk. With that said, we continue purchasing bonds with maturities towards the shorter-end of the curve. We continue to view the incremental compensation to assume interest rate risk (decreasing principal values if long-term rates rise) as not enticing enough to purchase long-term bonds. The second figure shows just how much the yield curve has flattened. Five years ago, investors were able to earn an incremental 2.60% by investing in the 10 Year US Treasury relative to the 2 Year US Treasury. Today, the spread is closer to 0.25%, reducing the incentive for investors to purchase longer-dated bonds.

To reiterate, our fixed income strategy continues to favor capital preservation over reaching for yield. In the current environment, that means a higher allocation to high-quality and short duration bonds than the broader fixed income market (for which the Core U.S. Aggregate Bond index is a good proxy). We will maintain this approach until we believe that we’re being adequately compensated to accept higher levels of interest rate or credit risk.