TFG INVESTMENT TEAM

READ OUR PUBLICATIONS

We send monthly newsletters to our clients, colleagues, and interested parties.

Market Commentary – Taking Stock of the Bull and Bear Case

Market indices have had heady returns over the last several years. The S&P 500 index has had double-digit gains in five of the previous six calendar years, compounding at an 18.5% annual rate over the past five years and a 16.5% clip over the past ten years. Comparatively, since 1928, the index has...

Speculating vs. Investing

Over the past several weeks, significant volatility in the share price of video game retailer GameStop dominated news headlines. The shares began to soar at the end of January when investors united on social media platforms to drive the stock price higher (an outcome that was possible given the...

Our Perspectives on 2020

When we wrote to our clients at the end of 2019, we opened with the following message: “As we begin a New Year and a new decade, many financial experts are polishing their financial crystal balls in an attempt to predict what the market will – or won’t – do in 2020 and beyond.

Navigating Uncertainty and Volatility

We’re currently in the midst of a period of heightened uncertainty, volatility, and panic due to the COVID-19 (coronavirus) pandemic. Clients are justifiably worried.

The Perils of Market Timing

Following a choppy start to 2018, the U.S. stock market climbed 8% in the third quarter. However, most of those gains were given back during the recent sell-off. Even with the pullback, longer term returns have still been impressive: through October 24th, the trailing five-year and ten-year returns...

The Path to Value Realization

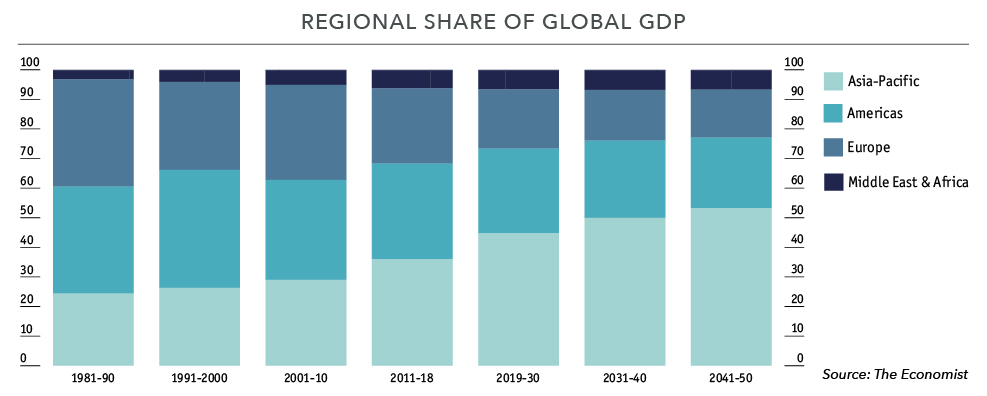

For many years, we’ve heard market prognosticators proclaim that the current bull market is nearing its fateful end. Between the Euro crisis, the U.S. debt downgrade, concerns about China, Brexit, the “taper tantrum,” and now the threat of an expanding trade war, they have offered plenty of reasons...

Notes from the Investment Team

2017 was another banner year for investors. The total return (inclusive of dividends) for the S&P 500 was a gain of 22%. There were not any meaningful hiccups along the way; as shown in the chart below, the index posted positive returns in every single month of 2017. International stocks fared even...

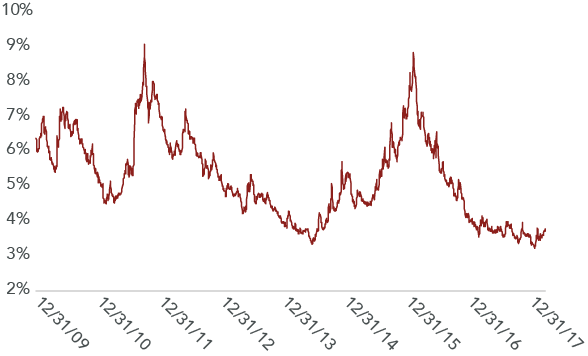

Keeping Our Eyes on Access to Capital

In 2007, you could count the number of companies with a “AAA” credit rating on two hands. General Electric (GE) was among that select group. But decisions made by management over the preceding 10-15 years eventually led GE to lose that top credit rating in 2009 – and seriously tested the company’s...

Notes from the Investment Team

2017 was another banner year for investors. The total return (inclusive of dividends) for the S&P 500 was a gain of 22%. There were not any meaningful hiccups along the way; as shown in the chart below, the index posted positive returns in every single month of 2017. International stocks fared even...

Investment Approach Revisited

The S&P 500 continued its march higher in the third quarter and has now increased by 14% (including dividends) in 2017. International markets have reported even better results, with the MSCI World index (ex-U.S.) climbing 21% over the same period.