TFG INVESTMENT TEAM

READ OUR PUBLICATIONS

We send monthly newsletters to our clients, colleagues, and interested parties.

Where We Are in the Cycle

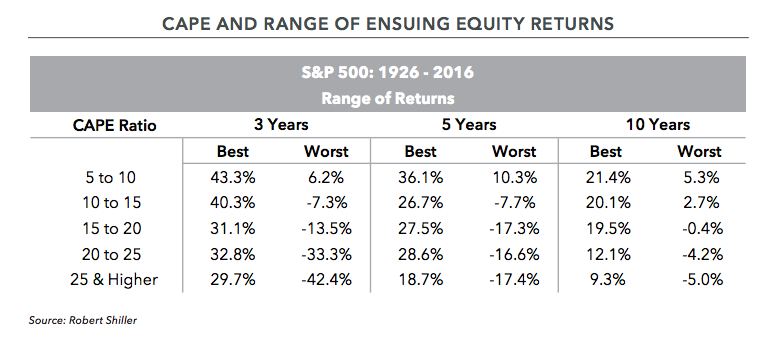

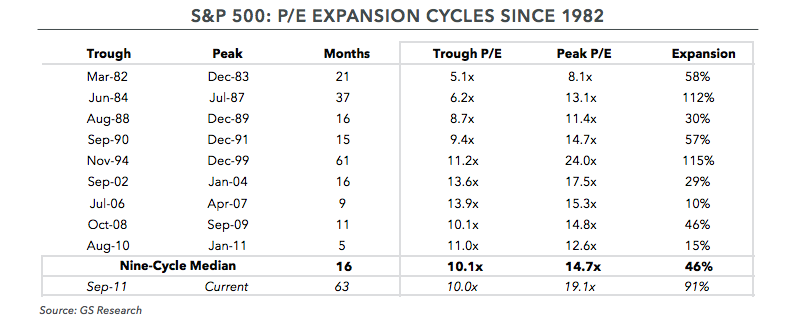

In the fourth-quarter newsletter, we discussed how we think about long-term equity return expectations. The purpose of the article was to explain how fundamental returns (driven by earnings growth) and speculative returns (driven by changes in valuation) collectively impact market prices. While...

Expectations for Future Equity Returns

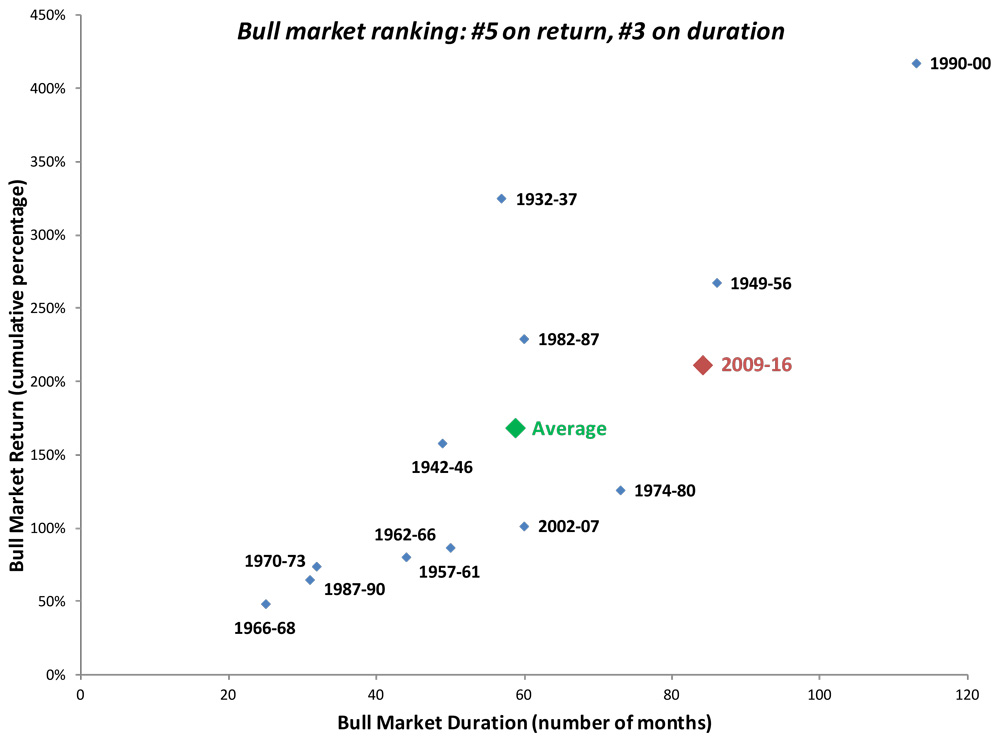

The S&P 500 reported its eighth consecutive year of positive returns in 2016, a feat last achieved in the 1990’s. That winning streak appeared in question in early November, with the S&P 500 up roughly 2% for the year. As the U.S. Presidential election approached, the consensus among market...

An Asset Manager Embraces Financial Planning

I have been investing other people’s money for over 36 years. As most of my clients are either saving for retirement or living off of their retirement savings and/or trust accounts, my overriding goal has been to build durable, income-producing portfolios that will enable my clients to live off of...

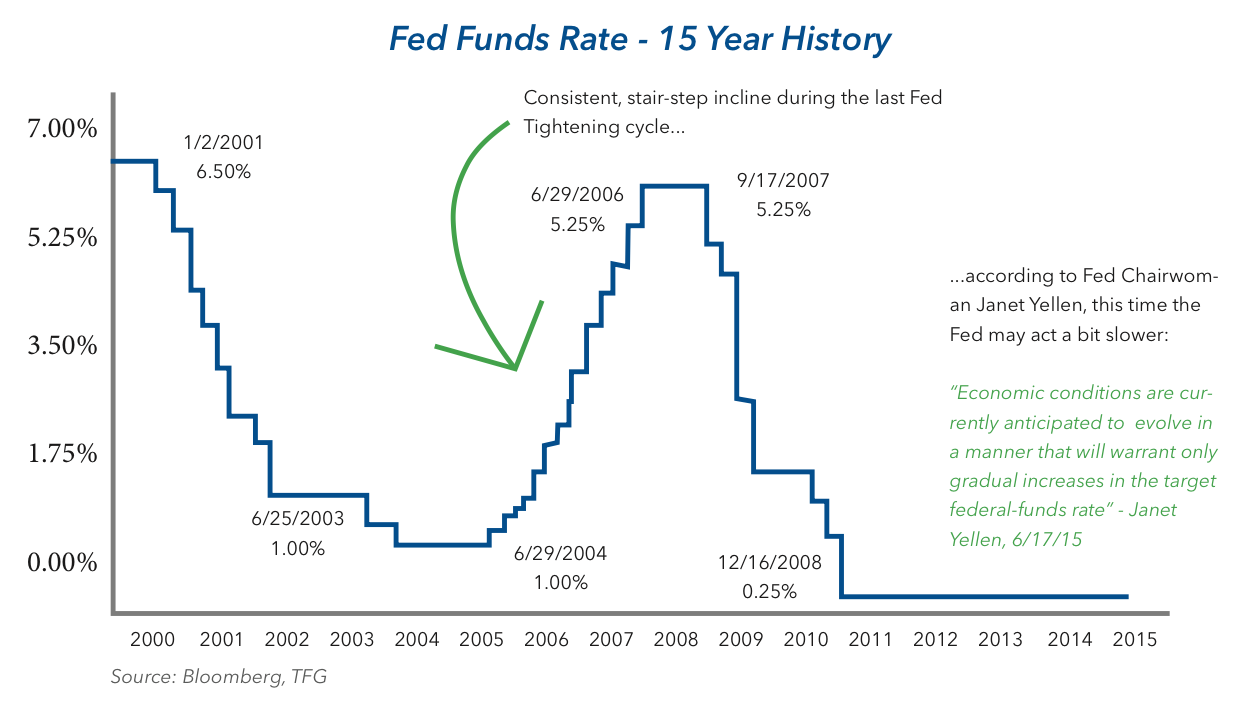

Navigating Macro Choppiness

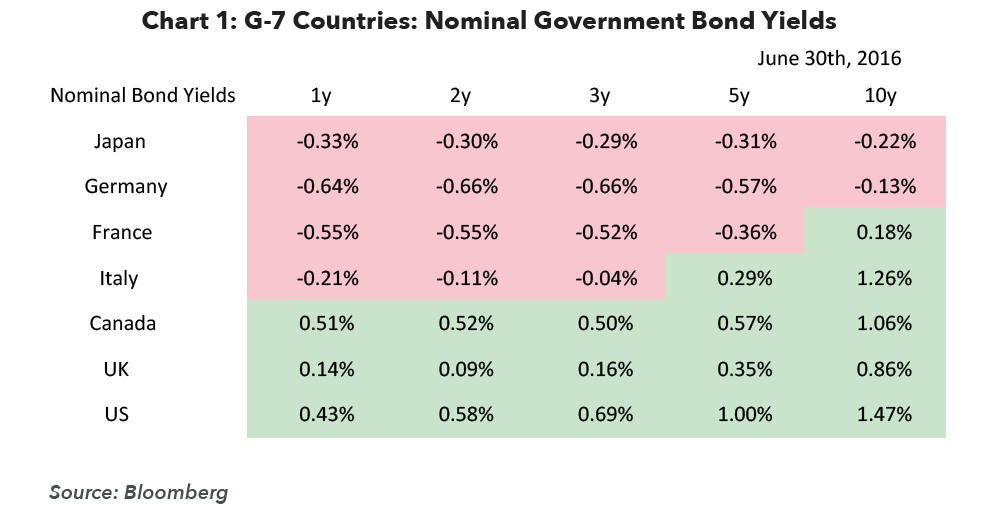

At the 2016 Berkshire Hathaway shareholder meeting, Warren Buffett and Charlie Munger were asked about the impact of negative interest rates when valuing a business. Warren’s answer touched on the peculiarity of the current environment and how it impacts decision-making at Berkshire Hathaway....

Long-Term Thinking

The sideways market of 2015 became even more indecisive in the first quarter of 2016. The S&P 500 Index stumbled out of the gates, and was down more than 10% by early February. In the ensuing weeks, the Index made a strong turn higher, ending the first quarter up marginally. At quarter end, the...

Search For Yield Continues

As with most investors, our goal is to maximize the total return that we receive from an investment (within a risk-adjusted framework). Total return is comprised of two components: 1)the income received (interest from fixed-income investments and dividends received on equity investments), and 2)...

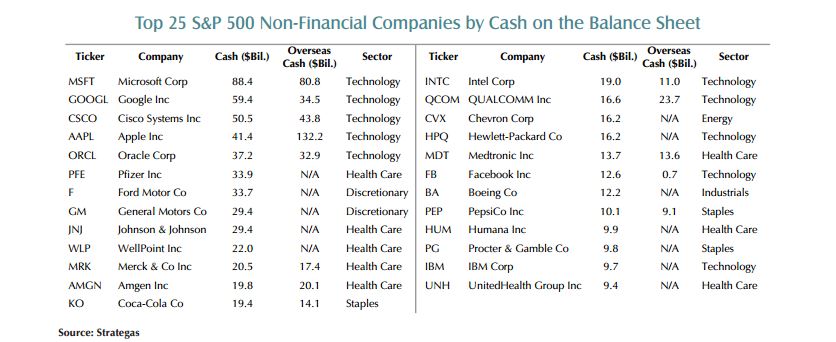

Corporate Cash Allocation Decisions

Although the economic recovery since the 2008 financial crisis has been less than robust, companies have been doing quite well. Corporate profits as a percentage of GDP are at record levels, as companies have benefitted from the tailwinds of low interest and labor costs, while also focusing on the...