CONSERVE. PLAN. GROW.®

The Beginnings of The Fiduciary Group: 1970 – 2000

February 27, 2020

The beginning of The Fiduciary Group dates back to the summer of 1969. I was the Vice President and manager of the trust department of a major Savannah bank.

Banking was in turmoil in 1969, including my employer. Under the management at the time, the bank was overextended. It had too many bad loans and not enough cash. I remember getting a telephone call from one of the trust department’s top officials. He told me the bank needed funds and my trust office was directed to come up with $1 million from our clients’ accounts to purchase the bank’s CDs.

I was shocked speechless. For the first time, I was asked to serve the bank’s interests ahead of its trust clients, to whom it owed a fiduciary duty to act in their best interests. I decided then and there that never again was I going to be in that position. That night, I went home and told my wife that I was leaving the bank, but it would have to be after the end of the year.

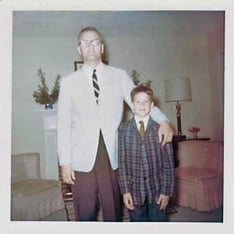

While the actions of the bank did trigger my determination to leave, I always had in mind to start my own business. My wife was totally supportive, even though she had major concerns about our finances, since, our oldest daughter was starting Duke University that fall. All four of our children were equally supportive. They came to me and said they wished to cancel their weekly allowance.

On February 1, 1970, I began an investment management business under the name of C. Lee Butler Financial Management on the second floor of 18 East Oglethorpe Avenue. On February 2, 1970, the S&P 500 closed at 86 (2/1/70 was a Sunday). Over the past 50 years, the price has increased from 86 to 3,226 (price on 1/31/20).

My monthly rent was $175 and my telephone expense was $16.50. An annual subscription to The Wall Street Journal and some used furniture rounded out my initial investment. Total overhead was about $250 a month.

I was in business for a few months when I came to the realization that I needed more backing. Needing legal advice and general support, I called on my friend, B.H. Levy. With B.H.’s advice and encouragement, I visited a number of Savannah’s leading citizens. I was looking for a group of initial investors, which eventually consisted of J.D. McLamb, Virginia R. Oxnard, Fred Wessels, Jr., H. Dale Critz, William W. Osborne, M.D., William B. McKenna, David J. Morrison, Frederick F. Williams, Jr., William H. McNeal, Will D. Weeks, Sr. and S. Elmo Weeks. Many of these would become the company’s board of directors.

We soon found out from B.H. Levy, who had asked Alan Gaynor (who later joined our board) to check out the feasibility of establishing an independent trust company with the Georgia Superintendent of Banking and Finance, that the answer was decidedly negative. The next decision was to organize a private corporation without trust powers to serve as investment manager for individuals, estates, trusts, and retirement accounts. First Estate Services Corporation was organized in June 1971 and began business on January 1, 1972. We became a Registered Investment Adviser under the Securities and Exchange Act of 1933, and I served as an individually appointed professional executor and trustee.

Starting my own business required more than simply replicating what I had done as a bank trust officer. I wanted to adopt what was right about the “trust system” and avoid the mistakes I had seen over the years in working with bank customers. One big plus in this direction involved being a Registered Investment Adviser. Under its rules we provided investment advice for a stated fee. Having no investment products of any form to sell allowed us to concentrate on providing impartial advice. Therein lies the chief difference between an investment advisor and a stockbroker.

The first year, our revenues were about $38,000 and a small profit resulted. My salary was $12,000 a year. At my former employer, I was earning $20,000 a year.

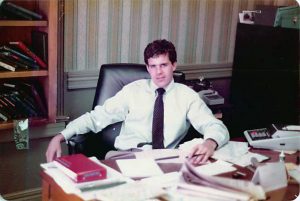

In the mid-seventies the company’s name was changed to Fiduciary Services Corporation. My son, Malcolm Butler, arrived on the scene in May of 1980, a newly minted Duke graduate. In September 1982, he took leave to attend the University of Georgia Law School.

Two big surprises awaited me as this business got underway. Surprise number one came quickly. Prospective clients wanted investment advice first, and only afterward would there be a possibility of acting as executor or trustee. At that time, my expertise did not really extend to the selection of stocks and bonds. However, I learned fast.

Surprise number two was perhaps a more justifiable misconception on my part. After all, I came up through the trust business ranks with prejudices in favor of well capitalized banks. I had failed to understand the dynamics of personal money management. I simply believed that people of means would feel the need for a big bank’s protection of their assets. We soon discovered that the personal relationship we had with clients and the impartial advice we could give them on a myriad of household financial concerns, together with our hands-on approach to money management, was all that was needed to gain their confidence.

Government regulation was another learning experience. I had been in business for eight or ten years when a woman showed up one day and said she had come from the United States Securities and Exchange Commission and that she was there to audit our business operations. She asked me how I wanted to handle her requests for information on various accounts. I told her she could look in any file and ask for whatever she could not find. She told me she was used to investment managers who would provide nothing except by a formal request and with approval of the firm’s lawyer. When her audit was over, she said we gave more service for less cost than any other investment counselor she had ever audited.

Beginning with Malcolm’s return from law school in 1985, assets under management began to grow rapidly. Internal management was a pen and pencil activity until 1980. As Malcolm became more experienced in trust accounting and also took on a more authoritative role in directing our business, he was determined to find an integrated software system that could replace much of the manual work. We ultimately chose the Trust Processing system. From that point, we continued to move on to better systems every few years. In the early ‘90s, we moved the custody of client assets to Charles Schwab, which has since served as the primary independent custodian of our clients’ assets.

For a company that began its operations 50 years ago, we can boast of the longevity of our early key employees. Malcolm Butler joined the firm in May 1980, Debra Bragg came in February 1982, and Jean Walz arrived December 1991 — all of whom are still with The Fiduciary Group today. In 1998, Malcolm became Chief Executive Officer as I moved to the office of Chairman.

Fiduciary Services Corporation developed a special niche in assisting several hundred of Savannah’s leading families in the management of their finances and the transfer of assets from one generation to the next. By being readily available to clients at all times, if conditions warranted, we were called upon regularly to find answers to much more than just investment questions.

A significant advantage to this type of business has been the strong relationships we’ve enjoyed with legal and accounting professionals. Most of the lawyers we have been involved with are both competent and honest in their dealings with us and our mutual clients. Over the years, we have worked with many accountants, especially in the area of tax return preparation.

Throughout the business and professional communities, we developed excellent working relationships with quite a number of individuals. As to each of the banks we dealt with, we usually found a senior employee who really understood banking and finance. Such a person became a great problem solver for us and facilitated transactions for our mutual clients.

Our earlier years were marked by frequent changes of location. The first office, located at 18 East Oglethorpe Avenue, was the second floor of a traditional Savannah residence in the National Historic Landmark District. Its major architectural feature was an unbelievably long and steep stairway from the first floor. On her first and only visit to our office, Mrs. Oxnard, one of our original directors, had to catch her breath for a full ten minutes. We moved after one year.

Next, we relocated to the Cluskey Building on Abercorn Street. We had an elevator that was so small that numerous clients preferred the stairway. A year or so later, we moved to the First Federal Savings and Loan building at the corner of Abercorn and Broughton. The elevator was adequate, and we enjoyed a good relationship with the First Federal people.

Then it was on to the old Savannah Bank building on the 13th floor. We had one of the best views of the river and the big ships coming and going. Our next stop was on the top floor of the Realty Building. It had a great view and lots of space. We ordered our first computer, an IBM 34, which was as big as a Volkswagen and had the capacity of no more than a modern day hand-held device. About five years later, we moved to the top of old Manger Hotel at Bull and Congress. This was a fine office with 20-foot ceilings and excellent office layout. We remained there for ten years.

In 1999, we made our final move to 310 Commercial Drive on the southside, where we occupy the second and third floors with our own elevator. Our landlord is Malcolm, who bought this attractive building.

No story of an organization like The Fiduciary Group can be complete without an understanding of the importance of our clients. Needless to say, they provide the funding for our operations. However, it is the clients who make the work interesting and worthwhile. Unfortunately, the privacy factor prevents us from discussing what we have accomplished, except in a general way. It will have to suffice to state that of all of the clients we have ever served, a majority are still active clients, including the trusts set up to transfer assets strategically and efficiently to the next generation.

A final word about our original directors. AII of them were and are outstanding in this community. I needed them to give this company instant recognition and credibility. They were and remain true friends who helped me when I needed help and at a time when I could offer them little in return for the use of their expertise, names, and reputations. I am deeply grateful for their support.

Malcolm will have to write the next chapter.

Lee Butler, March 21, 2001

Stay tuned for Malcolm’s chapter in next month’s newsletter!

*This article is an edited and condensed version of the original history of the firm written by Lee Butler in 2001.