READ OUR PUBLICATIONS

We send monthly newsletters to our clients, colleagues, and interested parties.

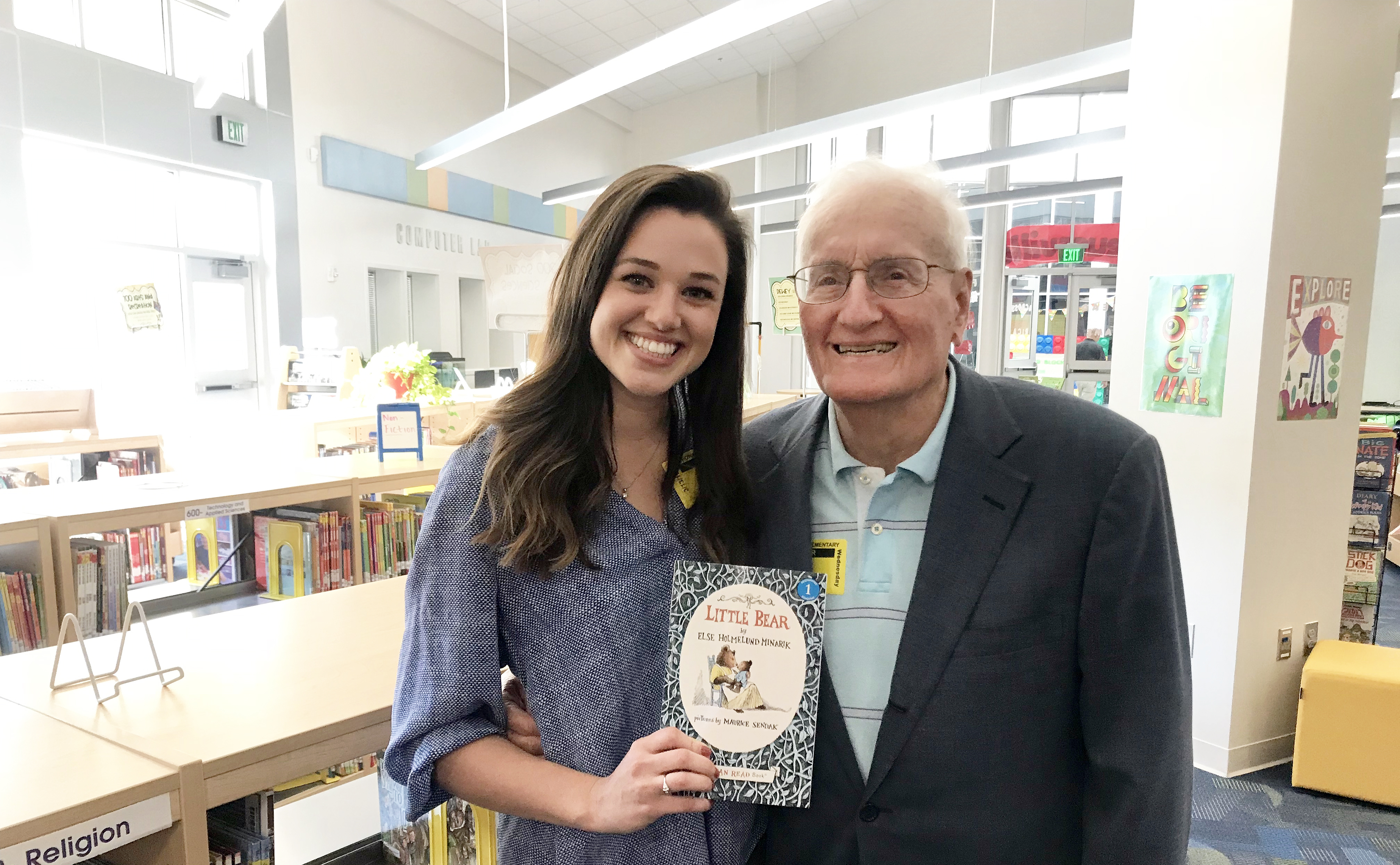

Advocates of Literacy

Bess Butler and Lee Butler, the founder of The Fiduciary Group, participated in the Savannah Rotary Read-In together on March 13th by reading the “Little Bear” book to first graders at May Howard Elementary. Bess and Lee gave a “Little Bear” book and a teddy bear to each of the 21 students in the...

The Value of Discretionary Investment Management

At The Fiduciary Group, we serve as fiduciary investment advisors. This means that we are required to act in the best interest of clients and to not place our own interests ahead of clients. As part of this relationship, we have the discretion to act on our client’s behalf and we endeavor to make...

6 Financial Planning Needs of Wealthy Families

You have enough money to support an affluent lifestyle — with more than adequate savings to spare. You’re not concerned about your ability to pay for your children’s college or fund your retirement. But significant wealth comes with its own set of challenges and complexities.

Building Teamwork

Vince Lombardi said teamwork was… “Individual commitment to a group effort — that is what makes a team work, a company work, a society work, a civilization work.” Many famous coaches and company leaders agree that teamwork is vital to success. The two youngest members of The Fiduciary Group,...

An Altruist Among Us

Since arriving at the firm in 2008, Scott has been a key member of the investment team and has helped drive TFG’s growth over the past decade. Outside of the office, Scott’s impact on the local Savannah community has been just as significant. His commitment to bettering the community is exemplified...

Coordinating Couples

If you and your significant other don’t always see eye-to-eye when it comes to finances, you’re not alone. When it comes to spending, investing, and planning, quite often couples are more divided than united.

A Rational Approach to Market Volatility

Through the first nine months of the year, it looked like 2018 would be another pleasant year for investors. The S&P 500 climbed more than 7% in the third quarter, pushing the year to date return for the index above 10%. But those gains – and then some – evaporated in the fourth quarter, with the...

A Financial Planning Christmas Carol

Maybe it’s the holiday season, but financial planning makes me think of Charles Dickens’s A Christmas Carol. Remember how Ebenezer Scrooge was visited by 3 ghosts—Christmas Past, Christmas Present, and Christmas Future? It gave him the opportunity to witness, from a reality-ringside seat, a view of...

Hiring a CFO to Manage Your Family’s Wealth

As you accumulate significant wealth, your financial world becomes increasingly complex. Your wealth may include not only stocks and bonds, but also private equity investments, real estate and perhaps a family business. Your estate plan may be complicated as well and may include a private...