JULIA BUTLER, CFP®, JD, MBA, CFEI

READ OUR PUBLICATIONS

We send monthly newsletters to our clients, colleagues, and interested parties.

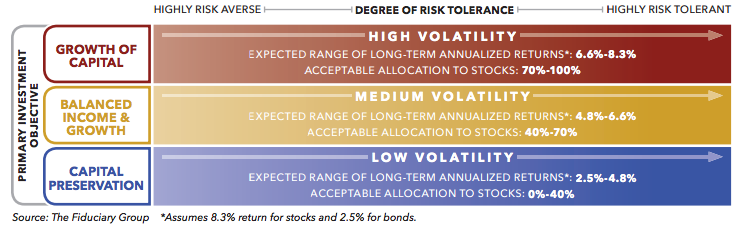

Choosing A Smart Investment Strategy

If you’ve ever looked at a graph of stock market returns, you might notice the similarities with an EKG. Lots of ups and downs. But overall, the trend is up. Over the long term, the stock market has delivered compounded annual rates of return of 8-10% per year. In order to achieve the long-term...

When I’m Not Working…

It all started with a small plot in a community garden. When I harvested my first bell pepper, I was hooked. After a few years bending over two planter boxes at ground level, I decided to “straighten up.” Literally, I wanted to stand up while I worked in my vegetable garden. With the help of Farmer...

An Antidote to Volatility

“Antidote”: Something that works against an unwanted condition to make it better.

Estate Planning For Life!

Estate planning is really “transfer planning.” It is an ongoing exercise of planning how you accumulate, conserve, and distribute your assets during life, at death, and beyond. There are both financial and non-financial reasons to plan. These range from minimizing income and estate taxes,...

Countering Volatility with Counterintuitive Action

My mom asked me once how I swallowed pills. “Show me,” she said. I went through the motions of pretending to put a pill in my mouth, mimed the act of taking a sip of water, then leaned my head back and swallowed. “That’s exactly the opposite of what you should do,” she said. “Instead of leaning...

The Benefits of Trusts

Trusts can serve many purposes in a family’s financial, retirement, estate, and tax planning. Trusts can ensure that assets are professionally managed across generations and distributed in line with the grantor’s intentions. Trusts can, among other things, remove assets from one’s estate, carry out...

Primer on Individual Taxes

Tax planning to minimize tax liability and maximize after-tax returns starts with an understanding of Form 1040, the tax return filed annually by individual taxpayers. My goal in this article is to give the reader a “primer” on Form 1040 and the key considerations that will impact your tax...

Gift and Estate Planning

Whenever you transfer assets to another person, whether during your lifetime or at death, there are potential federal and state tax consequences. Good financial planning can help minimize taxes and also help you better accomplish your gifting objectives. Although most households will not face Gift...

Legacy Planning

Within the last year, my husband and I revisited our estate plan. In the end, we felt confident that we’d accomplished all the usual objectives—protecting and preserving financial assets for future generations, minimizing taxes, and so forth.

How Much Do I Need for Retirement?

Legg Mason posed the question “how much do you need for retirement?” to a group of “mass affluent” investors (aged 40 – 75 with more than $200,000 in investable assets). Those surveyed said they would need at least $2.5 million to maintain their current standard of living. According to the...