MALCOLM BUTLER

READ OUR PUBLICATIONS

We send monthly newsletters to our clients, colleagues, and interested parties.

It’s a Mixed-up Investment World!

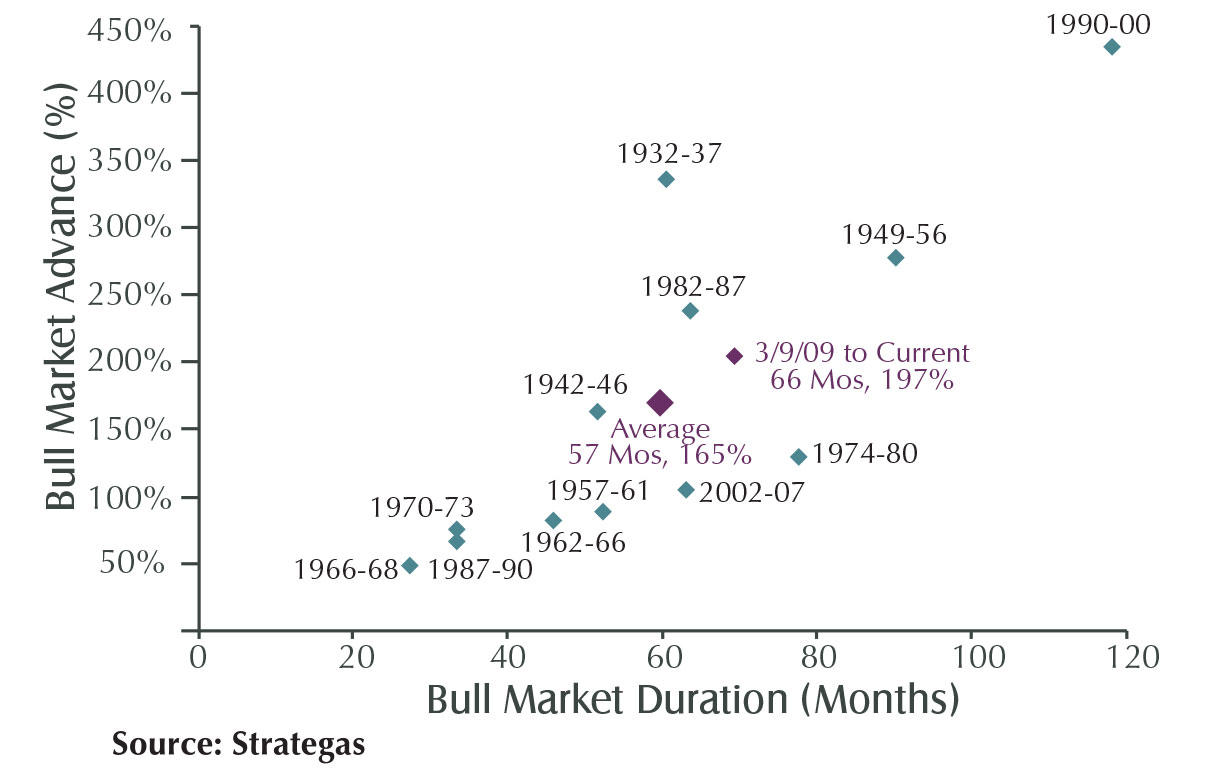

Source: Strategas The most successful investment theme in 2015 centered on investing in high growth stocks like Alphabet (formerly Google), Amazon, Facebook and Netflix. In a slow growth economy, investors placed a premium on companies that could deliver high revenue growth. Thus far in 2016, by...

The Silver Lining

Two thousand and fifteen was a challenging year for investors. Outside of some very large companies with high growth rates (Amazon and Facebook, among a few others), the majority of stocks in the S&P 500 ended the year with negative returns.

Entrepreneurial Estate Planning

Over the years, a number of clients and friends have approached me to assist them with their estate planning needs. Because my legal license is inactive, I don’t draft estate planning documents. However, with over 30 years of experience in administering estates and trusts, I can often bring an...

Rising Equity Glidepath in Retirement

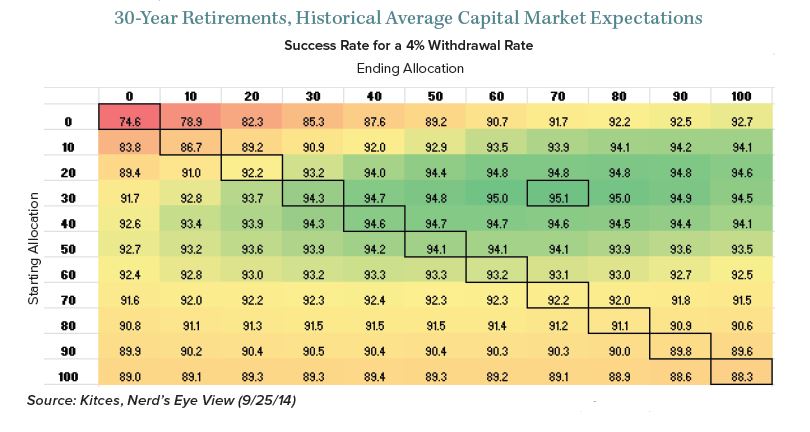

Conventional wisdom in the investment advisory world has typically been that retirees should gradually reduce their equity exposure during retirement. One popular rule of thumb is that equity allocations should be annually rebalanced based on a formula of 100 less the retiree’s age. For example, a...

Investing Cash in Bull Markets

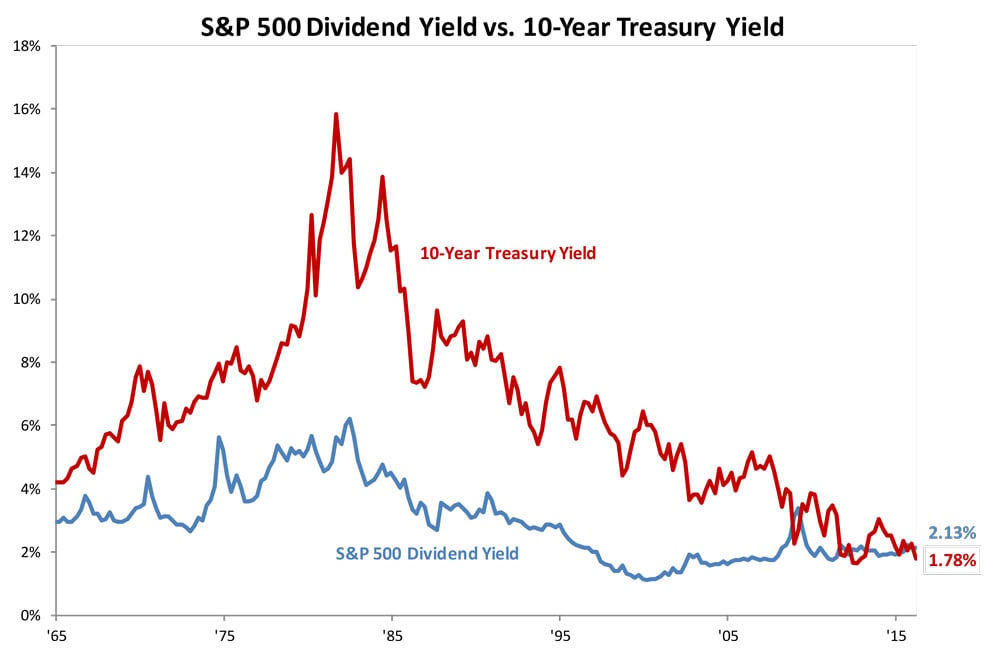

A common question that I frequently hear from our clients at The Fiduciary Group is “how can we invest fresh cash in stocks and bonds when prices seem so high?” Stock indices have repeatedly set new records this year, and bond prices have moved higher as yields have hovered near historic lows....

Advice to My Children

In our last newsletter, I wrote about the investment advice that I learned from my father. In this issue, I will pass on the investment advice that I would like to share with my three children in the hope that it might also benefit the children and grandchildren of some of our Fiduciary Group...

Lessons On Investing from My Dad

My father started The Fiduciary Group over 40 years ago with the idea that clients would come to him primarily for trust and estate administration (he previously worked in, and ultimately was the head of, the trust department of a local bank). Early on, he found that more and more clients wanted...

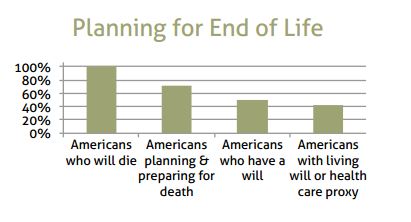

End of Life Planning

Since we are all mortal, we will all personally face end of life issues. It is essential to have appropriate documents in place that will address both financial and healthcare matters that ultimately arise. In a recent survey completed by Boomer Market Advisor, 50% of respondents did not have a...