CONSERVE. PLAN. GROW.®

Rising Equity Glidepath in Retirement

January 15, 2015

Conventional wisdom in the investment advisory world has typically been that retirees should gradually reduce their equity exposure during retirement. One popular rule of thumb is that equity allocations should be annually rebalanced based on a formula of 100 less the retiree’s age. For example, a 70 year old retiree should have 30% equity (100-70) under this formula, and each successive year that exposure would be reduced by 1%. The rationale for this approach is that retirees should not assume excessive risk of stock market declines in their investment portfolios. Recent research suggests that the optimal asset allocation for retirees, however, may actually be the complete opposite of the allocation contemplated by conventional wisdom.

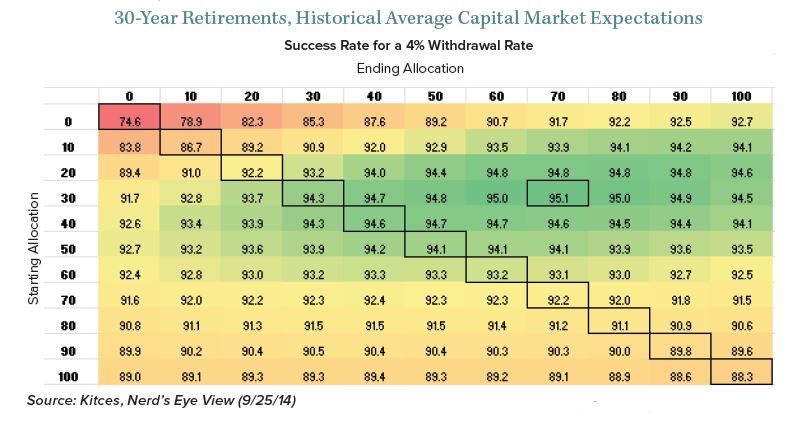

While attending an investment conference in November, I heard a presentation by Michael Kitces, a national expert on financial planning. He has extensively researched the most optimal retirement asset allocation strategy. In the course of his research, he discovered that it is best if the equity exposure increases gradually each year in retirement. He terms this approach a “rising equity glidepath” because the portfolio equity allocation glides higher each year during retirement. In his research, he employed 10,000 Monte Carlo simulations and he varied the capital market assumptions so that all types of market cycles were included in the study. In the chart below, Kitces shows the probability of success of various beginning and ending allocation strategies, assuming a 4% withdrawal rate and using the following historical returns: average annual compound real growth rate of 6.5% for stocks and 2.4% for bonds. The starting equity allocation is found on the vertical axis, and the ending allocation (assuming 30 years in retirement) is on the horizontal axis. For example, if you started retirement with a 70% equity exposure and ended with a 70% equity exposure, the probability of success is 92.2%. However if you started with a 30% equity exposure and increased it gradually to 70% over the 30-years, your probability of success is 95.1%.

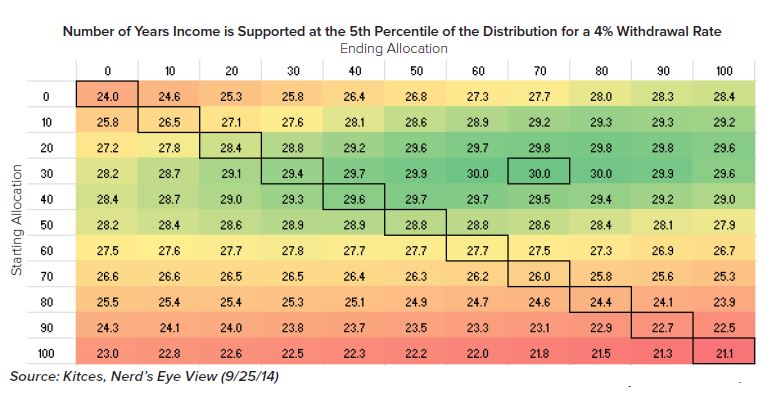

The second chart looks at how many years the portfolio lasts in the event the portfolio experiences the lowest 5th percentile of market conditions (a “really bad” investment outcome scenario). Kitces stress-tested how long the portfolios would last under the various beginning and ending allocation strategies in the 5% worst market scenarios. The glidepath portfolio that starts with 30% equity exposure and increases to 70% lasts 30 years, compared to the constant 70% portfolio, which is depleted in 26 years in the worst 5th percentile market environment.

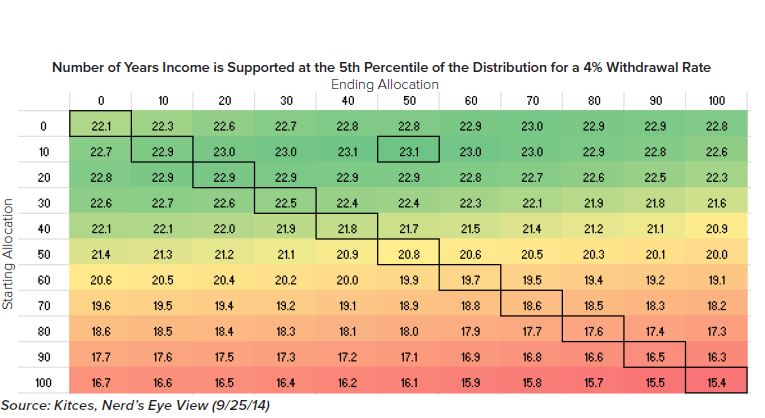

Kitces also tested his theory under an assumption that returns over the next 30 years will be diminished relative to historical standards. The chart below shows the glidepath results with the conservative (“worst case”) return assumptions that Harold Evensky recommends for the MoneyGuidePro financial planning software package: arithmetic real returns of 5.5% for equities and 1.75% for bonds.

Under the assumption of a reduced return environment, all the scenarios faced earlier failure points (the “best” is only 23.1 years at the 5th percentile). The optimal glidepath becomes even more conservative, starting at 10% and rising to only 50%. Kitces concludes: “Nonetheless, in this environment the rising glidepath effect is still present; in fact, the conservative rising glidepath lasts almost 20% longer at the 5th percentile than the static 60/40 portfolio.”

allocations in retirement seems quite risky. Kitces suggests that one way retirees may get more comfortable with increasing equity exposure is to think of it as a “bucket” approach. The bucket strategy assumes that the portfolio is broken out into three buckets. One is a pool of short term investments that might cover spending for the first three years of retirement, another portion is invested in intermediate term bonds that will handle the next 5-7 years of expenses, and the remaining portion is invested in equities that will cover spending that is a decade away. By spending out of these buckets in this sequential manner, the equity allocation of the portfolio will sequentially rise each year as the fixed income assets are spent down.

Kitces recognizes that the bigger risk to retirement portfolios is the sequencing of returns. A bear market in the early years of retirement can have a detrimental impact, notwithstanding the average returns of the portfolio over time. Kitces’ research shows that gradually increasing equity exposure is effective whether the early years of retirement are marked by good markets or bad markets. If it turns out that stock markets experience strong performance in the early years of retirement, the early portfolio appreciation will negate any later downturn in equity returns (not to mention that the appreciation in the stock portion of the portfolio will naturally increase the relative allocation of stocks in the overall portfolio). The retiree will likely end up with more wealth than anticipated, and a more conservative equity allocation may then be an appropriate option in the later years of retirement.

Kitces explains why increasing equity exposure in retirement, even in a bear market in the early years, makes more sense than decreasing equity exposure: “[T]he reality is simply that if market returns are poor throughout the first half of retirement, a rising equity glidepath is the equivalent of systematically dollar cost averaging into the market (with all the benefits that entails), while decreasing exposure [to stocks] amounts to reverse dollar cost averaging out of a bad market (with all the adverse results that apply).” And for retirees who endure a poor stock market in the early years of their retirement, the rising equity glidepath will rescue the portfolio as the stock market returns rise through the second half of their retirement. As Kitces concludes, the rising equity glidepath is a “heads you win, tails you ‘don’t lose’” asset allocation approach.