CONSERVE. PLAN. GROW.®

The Reemergence of the Blue Chip Nifty Fifty

July 25, 2016

“A blue-chip stock is the stock of a large, well-established and financially sound company that has operated for many years. A blue-chip stock typically has a market capitalization in the billions, is generally the market leader or among the top three companies in its sector, and is more often than not a household name. While dividend payments are not absolutely necessary for a stock to be considered a blue-chip, most blue-chips have a record of paying stable or rising dividends for years, if not decades. The term is believed to have been derived from poker, where blue chips are the most expensive chips.” Source: Investopedia

Investors have struggled to find reasonable, low-risk sources of cash flow for the past few years. When I entered the investment field 36 years ago, a retiree could comfortably rely on a super-safe Treasury bond portfolio to produce annual interest income that would sufficiently satisfy the cash flow needs of the retiree’s family. In those days of higher interest rates, a medium-term Treasury note typically paid 6-10% annually. Since that time, yields on similar duration Treasuries have gradually declined to today’s level of 1.0-1.5%. While the annual rate of inflation has also declined, most people have not seen their household expenses decline to the same extent as the drop in the income returns on their

bond portfolios.

While a US investor is able to purchase government bonds with yields of 1-2%, bond investors in many parts of the world are not so fortunate. Debt issued by countries around the world is yielding at all-time low levels. Sovereign debt totaling some $12 trillion is trading at negative interest rates. Approximately one quarter of the world’s sovereign debt has a negative interest rate. This means that investors are paying borrowers for the privilege of making a loan to the borrower!

The search for yield has led investors to seek safe alternatives to negative or low-yielding government bonds. Last quarter, I wrote on the migration of investors towards dividend-paying stocks as a substitute for bonds. This behavior has persisted through the second quarter and has helped to propel the values of those higher yielding stocks (as well as broader market indices).

As investors have bid up the value of dividend-paying securities, those same companies have responded by making their stock more attractive to investors. Many of those companies have been using profits to increase dividends or buy back stock (another form of returning capital to shareholders). Those companies are now paying out a sizable percentage of their profits to investors.

With such a large portion of the safest debt yielding zero (or lower), many of the world’s strongest companies are now perceived as a more reliable source of income than assets considered to be “risk-free.” Take Coca-Cola for example. The company has been in operation for over 100 years, has earned a very high credit rating, and has a dividend yield in excess of 3%. Coca-Cola’s dividend yield is significantly higher than the US Treasury 30-year bond. While Coca-Cola has achieved only modest revenue growth over the past few years, investors are so starved for current cash flow in their portfolio that they are favoring safe dividend payers over companies that have achieved higher earnings growth rates. Other companies that fit this similar description are Proctor & Gamble, Exxon Mobil, Johnson & Johnson, and Microsoft to name just a few. Perhaps we are seeing the beginnings of a new “Nifty Fifty” that is comprised of blue chip companies with strong balance sheets and high dividend distributions.

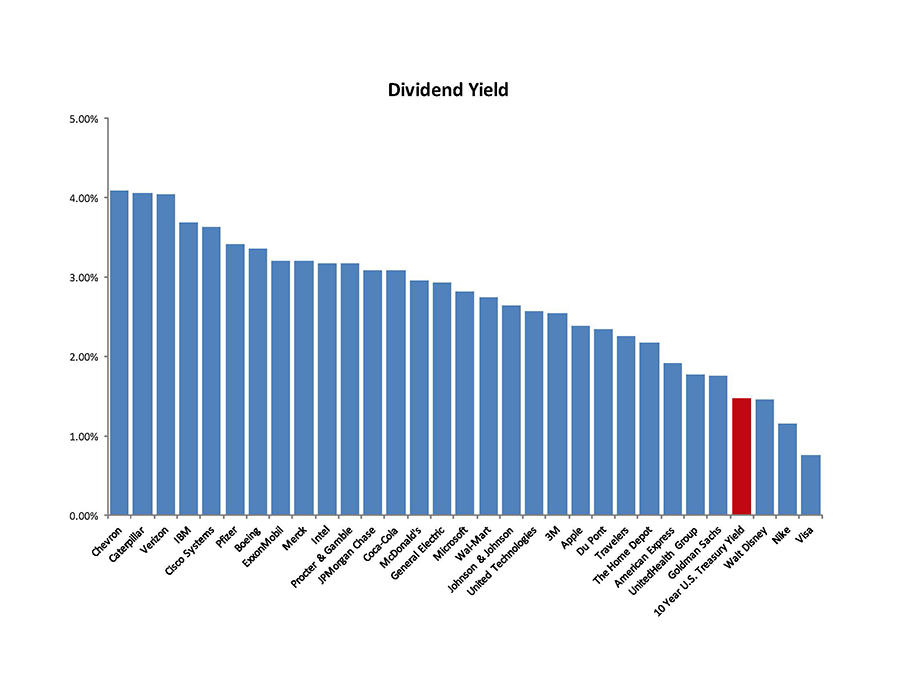

Take a look at the Chart. Of the 30 companies in the Dow Index, 27 are paying a dividend yield higher than the 10-year US Treasury!

The Nifty Fifty was an investment theme that began in the mid-1960s and captivated investors until the arrival of the bear market of 1973. The 50 stocks comprising the Nifty Fifty were considered “one decision” stocks that were some of the fastest growing and highest quality businesses in the world. These stocks were meant to be bought only and there was a “growth at any price” investment mentality. This originally sound premise was eventually taken too far. Investors bid up the prices of these companies so that their average price to earnings (P/E) ratio was a lofty 42 when the S&P 500 index P/E stood at 19.

While solid dividend paying securities do not sport the high altitude P/E ratios of the Nifty Fifty, investors have bid up dividend paying stock prices to levels that might formerly have been associated with faster growing companies. Companies like Coke, P&G, and J&J all have P/E ratios that are materially higher than the S&P 500 index. Those higher P/E ratios are likely a result of the relative value that the dividend distribution plays in relationship to long term interest rates. The declining interest rates paid on bonds has had the effect of increasing valuations. In addition, investors’ quest for increasingly scarce yield has caused them to bid up prices of companies that offer stable and reliable cash distributions.

There may be another factor at play in the increased valuation of many of these stocks. There were around 8,800 publicly traded stocks on all US exchanges in 1997. At the end of 2015, that figure had been reduced to 5,300. There are simply far fewer publicly traded companies available for investors. As the number of publicly traded companies has declined, there has also been a significant rise in the number of hedge funds that invest a large portion of their assets in the public equity markets. There are now over 8,500 hedge funds who, along with other large institutional investors like endowments and pension funds, are all investing a portion of their assets in a shrinking public market for equity investments.

The Nifty Fifty of the 1960s was characterized by fast growing companies. Investors optimistically believed in a new sense of manifest destiny, with American companies leading the world in business and commerce. This investor optimism resulted in very high company valuations. Today’s Blue Chip Nifty Fifty is characterized by security and income rather than explosive business growth. In an era where super safe investments generate negative to low cash returns, investors have come to favor high credit quality equity securities operating stable businesses that have a history of distributing a reliable cash return to investors. As long as interest rates remain low and the supply of publicly traded stock is constrained, valuations of these blue chip stocks are likely to continue to remain strong and elevated.