CONSERVE. PLAN. GROW.®

How to Determine Your Ideal 401(k) Asset Allocation

October 29, 2020

There are three major factors that impact your retirement goals: how much money you save, how long you save, and the rate of return on those savings.

Quite often, investors focus on their short-term rate of return, which is the factor over which they typically have the least control. In fact, research conducted by Vanguard indicates that “88% of your experience (the volatility you encounter and the returns you earn)” is due to your asset allocation as opposed to the “specific investments” you choose. That’s why it’s far more important to put your energy into saving as much as you can for as long as possible and to carefully consider the asset allocation strategy within your 401(k) account, rather than focusing on short-term performance.

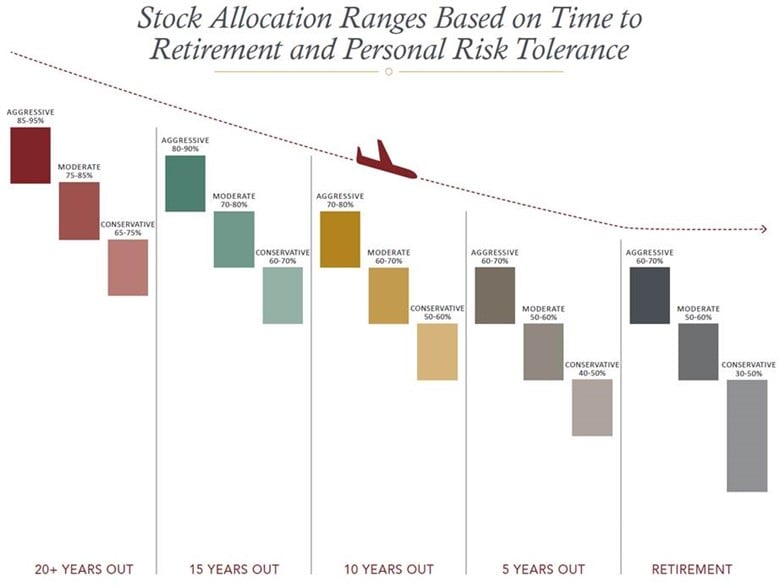

Asset allocation is a way to balance the risk (volatility) and reward (returns) in your 401(k) account through a mix of stocks, which tend to have higher returns and higher risk, and bonds, which tend to have lower returns and correspondingly lower risk. Your allocation strategy should reflect your goals, risk tolerance, and time horizon. The aim is to encourage growth while managing risk over time through a diversified investment portfolio.

Understanding Your Risk Tolerance

Everyone’s retirement goals and income needs are unique, so there’s no “one-size-fits-all” solution to investing your retirement funds.

Your anticipated retirement timeline is an important consideration when it comes to 401(k) asset allocation. If you’re not planning to retire for 30 years, you have time to ride out short-term market swings that might impact your account balance, which means you can assume more risk in pursuit of higher returns over time. In contrast, if you’re within five years of retirement, you won’t have as much time for the market to “bounce back” if a market decline occurs. In this case, you might be better off selecting a more conservative investment strategy.

Additionally, each of us has a different perception of volatility that impacts our willingness to take risks regardless of our timeline. Both the ability AND the willingness to bear risk in your accounts must be considered. It’s important to find the balance between the risk you need to take to achieve your goals and your tolerance for volatility to avoid making panicked decisions during down markets.

The following Glide Path chart helps to illustrate how these factors might impact your asset allocation decision:

So How Do You Determine Your Risk Tolerance?

A good place to start is with a risk tolerance questionnaire. Your 401(k) recordkeeper may have one available through their website, but most custodians (Charles Schwab, Fidelity, etc.) make a version publicly available as well. A good questionnaire should have a variety of questions relating to quantitative measures like age or time horizon as well as qualitative items like your personal views on risk and reactions to short-term market volatility.

Selecting Your Strategy

Once you identify your risk tolerance, your retirement plan likely has several strategies to meet your needs. Here are a few examples.

- Target-date funds, which are intended to align with your projected retirement date. These funds invest in both stocks and bonds and follow a glide path similar to the chart above. The allocation becomes more conservative over time without you having to make changes.

- A risk-based balanced mutual fund, run by a professional money manager, can be invested to a stated level of investment risk. These funds invest in varying levels of stocks and bonds and are often referred to as growth, moderate, or conservative allocations. Although these funds are rebalanced by the manager, it is important to remember that the allocation will remain at the stated risk target, while your risk tolerance may change over time.

- Build your own portfolio using mutual funds available within your 401(k) plan menu. This option gives you the most control, but also requires the most attention as you are responsible for rebalancing the funds and making changes as necessary.

Talk to your 401(k) plan’s investment advisor for help understanding the specific options available in your plan.

No “Risk-Free” Lunch

Remember that your asset allocation strategy will not eliminate all risk, but is meant to build a portfolio that will keep you invested in both up and down markets. By implementing a strategy based on your needs and goals, you can avoid the pitfalls of focusing on short-term returns and focus your attention on the other keys to success – saving as much as you can for as long as you can.

Need help with retirement planning? Please reach out to us to get started.