CONSERVE. PLAN. GROW.®

Understanding Stock Ownership, Earnings, and Dividends

April 3, 2023

Recently, a well-informed client asked me: "If I own 5% of a company's stock, does that mean I get 5% of the earnings?" It's an interesting question that got me thinking about company earnings, dividends, and valuation dynamics.

The short answer is that owning 5% of a company's stock does not entitle you to 5% of the earnings. Instead, in most cases, it entitles you to a 5% vote towards electing a company's board of directors and 5% ownership of certain corporate actions such as dividends. So the first thing to understand is the different roles and responsibilities for a public company.

Shareholders own the company, and they elect a board of directors to provide oversight of the company's strategy and performance, and to hire the CEO to execute the company's strategy. This setup results in mutualism, where all parties have a common interest protected by each other's behavior. While many individual shareholders would love to be able to bestow upon themselves 5% of earnings based on their 5% of stock ownership, that would not be in the best interest of all shareholders. The board relies on management to share information to make the best decisions, and owners approve their actions. These intertwined relationships are meant to put checks and balances in place to ensure appropriate governance and accountability.

The CEO and management team execute the company's strategy to generate and grow earnings and cash flow. To maximize long-term shareholder value, a company's management team needs to decide how it will allocate its profits, with the board's oversight and approval. Their main choices are:

- Reinvest into the business – The idea of reinvesting earnings back into the company is that these investments will earn a high return on investment, leading to increased earnings and an increased share price.

- Make an acquisition – Acquisitions typically have an end goal similar to reinvesting in the business: increasing the share price over time.

- Pay a dividend – Companies tend to reach a point where their earnings exceed their reinvestment opportunities and begin to pay dividends. From a shareholder perspective, dividend policies are expected to be reasonably permanent, with dividend growth expected over time.

- Buyback shares – Rationale is similar to paying a dividend, except there lacks an expectation of permanence. From our perspective, this is the least desirable use of earnings unless the company's shares are undervalued.

Stock Return Composition

How do company management and its board of directors' decisions translate into stock returns? Stock returns come from earnings (more specifically cash flow, but we'll stick with earnings), dividends, and what investors are willing to pay for those earnings and dividends (valuation). A common valuation metric that most clients recognize is the Price-to-Earnings Ratio (P/E Ratio), but note there are many ways investors value a company beyond P/E Ratio. Using these components, your stock return could be approximated by the following equation:

“Earnings Growth + Dividends + Change in P/E Ratio = Stock Return”

Management decisions to achieve consistent earnings growth and dividend growth impact the valuation multiple that investors pay for a stock. For example, if you were buying a business, you would be willing to pay a higher valuation for higher earnings growth, and/or consistent earnings growth, and/or consistent ability to pay and grow dividends. Investors similarly reward stocks for demonstrating consistent earnings growth and building company value over time.

Valuation Oscillation

Because investors tend to reward consistently strong companies with higher valuations, finding these quality stocks at a discount to their expected value can be difficult. It's intuitive to want earnings growth, consistency, dividends, and sound balance sheets, but you don't want to overpay for them. The valuation aspect (in our simple equation, P/E Ratio) is where investor sentiment can dictate over and underpricing relative to what financial results a company can deliver over time.

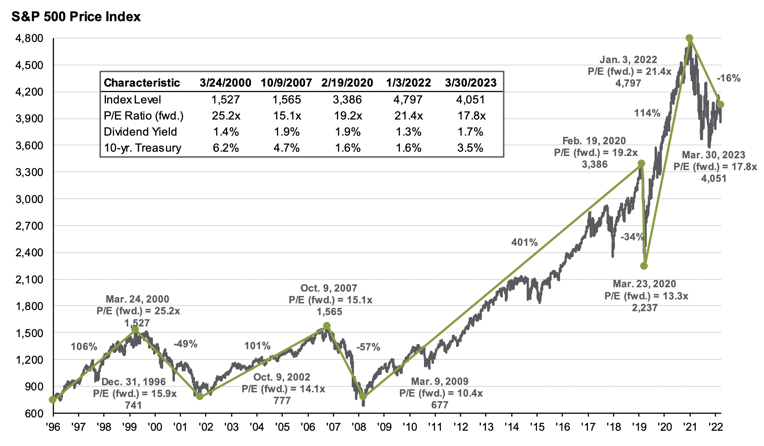

Valuation is where investor short-termism is exhibited. Short-termism can occur in both directions and be too pessimistic or too optimistic. Heading into 2022, the market was too optimistic about what companies could achieve last year and in the future. Despite a market decline of 17% for the calendar year 2022, earnings only declined 4%, and when you add back 2% for dividends, the valuation investors were applying to the market fell by approximately 15%. Let's see this demonstrated in the following chart by J.P. Morgan Asset Management:

Looking at the above historical chart on the S&P 500 Index forward P/E Ratio, post-covid had the highest reading since the late 90's tech bubble. So it was natural that valuation would revert towards the long-term average, but macroeconomic factors changed rapidly during 2022, accelerating reversion to the mean.

Time, Discipline, and Patience

Warren Buffet wisely observed that "Successful investing takes time, discipline, and patience. No matter how great the talent or effort, some things just take time."

Investing involves many complex factors, so that endless details can be added to Buffet's observation. Still, a long-term time horizon for investing is critical to ensure adequate returns and to achieve financial goals. Let's assume the "right" stock was identified, purchased, and added to your investment portfolio. Growth then serves as the goal, and understanding what makes the value of a stock increase will help maintain the most underappreciated investor attribute: patience.

Humans are emotional creatures, so decisions are not always rational. That's why market sentiment, a considerable driver in stock valuation, can be challenging to gauge. A specific company or an entire industry can go from hero to villain in a matter of days (as we observed during the recent bank closures) or over months or years. Depending on the news, some investors see irresistible opportunities while others are put off by untenable risk.

Long-term Portfolio Construction

At The Fiduciary Group, our investment portfolios are diversified, tailored to individuals, and defined by a long-term approach to investing. We strategically build portfolios that strive to handle inevitable periods of volatility. We continuously monitor results and evaluate alternative options, while placing our clients' best interests and needs first.

As always, clients are invited to contact us for more information about stock earnings, dividends, valuation, and how they relate. By maintaining discipline, we can take advantage of opportunities and monitor potential warning signs to protect your portfolio. We are here to help, so be sure to speak to your advisor if you have questions about your personal investment strategy.