CONSERVE. PLAN. GROW.®

Planning Throughout the Retirement Lifecycle

December 30, 2020

We generally think about retirement in three broad phases. Within each phase, distinct trends and priorities have emerged among retirees in the numerous studies that have been completed on the topic. Each client has their own unique plans for retirement, but understanding these general patterns provides helpful context and is a great starting point for crafting a customized retirement cash flow plan.

Three Phases of Retirement

Here’s an overview of the three phases of retirement:

PHASE 1 – The first phase of retirement is typically defined by active pursuits and newfound freedom. This is a time to pursue your passions and focus on the activities you didn’t have time for during working years. Whether your dream includes traveling abroad, serving on boards or volunteering, perfecting your golf game, purchasing a home in the mountains, or picking up a new hobby, the first phase of retirement tends to be fun, lively, and costly. Phase one retirees appreciate having the time and financial means to enjoy their preferred activities and are ideally in good health, so they can savor life after exiting the workforce.

PHASE 2 – The second phase of retirement is defined by a period of slowing down and is often accompanied by an overall contraction in spending. Phase two retirees continue to enjoy phase one activities, but typically at a more moderate pace. Financial expenditures tend to decline during the second phase of retirement, assuming your health remains stable.

PHASE 3 – In the third phase of retirement, discretionary expenses tend to decline as travel and other activities moderate, and the composition of expenses tends to change. Healthcare-related issues and expenses, for example, become more prevalent. You may need to think about assisted living or home healthcare, which can involve significant expenses. Medicare doesn’t cover all healthcare costs as we age, and 24/7 skilled nursing care can be a financial drain.

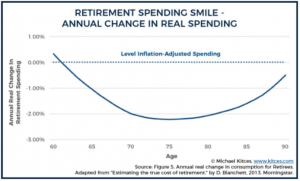

The Retirement Spending Smile

The so-called “Retirement Spending Smile” is a graphic that depicts retirement spending patterns over time. David Blanchett, the Head of Retirement Research for Morningstar, noted this phenomenon in a paper from 2014. A more recent study by Katherine Roy and Yoojin Kim-Steiner with J.P. Morgan uncovered similar trends. These studies found a surge in spending in the early years of retirement, followed by a decline in spending over time. In later years, the composition of spending tends to shift, with healthcare costs often increasing as a share of overall spending.

The Importance of Planning

Fortunately, it’s possible to plan strategically for all three phases of retirement, so you can enjoy yourself while being prepared for whatever may come your way in the future. At every stage of retirement, it’s important to meet with your advisor and to take into account your own spending priorities in order to develop a plan that’s customized to your specific needs.

Sequence of Return Risk

One important aspect of planning which is of particular importance during the early stages of retirement is sequence of return risk. As the name implies, this refers to the order of returns an investor earns over the course of a full retirement period. The order, as opposed to the average, of returns a portfolio earns has an outsized impact on the sustainability of portfolio withdrawals over time.

Poor returns early in a retirement lifecycle are much more destructive to long term portfolio values than poor returns earned in later years. This holds true because of the math of compounding returns. Poor returns early in retirement, combined with ongoing withdrawals and rising inflation, mean that your portfolio would have fewer dollars on which to compound in later years.

Managing investment risk carefully as you approach and enter the early years of retirement is critical. When developing plans for clients, we account for investment risk, but also age, alternate income sources, the level of flexibility in a spending plan, and other factors. We address the variability of investment returns by applying a “Monte Carlo” analysis to a retirement cash flow plan. This statistical method analyzes plan outcomes by using 1,000 different investment return trials. The various trials are based on historical risk and return data to stress test your preparedness for a variety of market environments.

Changes During Later Years

Spending patterns tend to change during later stages of retirement, but that’s not the whole story. Priorities also evolve over time. Legacy goals are one item that tends to receive increased attention over time. This can include charitable giving as well as strategies to effectively pass accumulated wealth from one generation to the next. Given the trends of increased healthcare spending later in life as well as an inflation rate for healthcare costs, which is approximately double that of core inflation, having a plan for managing healthcare costs during retirement is another key ingredient to a successful plan.

Financial priorities evolve over time, not to mention financial markets, tax and estate legislation, and family dynamics. It’s impossible to anticipate all the twists and turns you may experience during your retirement years, which makes it all the more important to not only prepare diligently in the years leading up to retirement, but also to continue to plan throughout your retirement years as well. Meeting with your advisory team on a regular basis and having a coordinated approach among your various financial, legal, and tax advisors are key components for continued success.

If we can be helpful as you prepare for retirement or navigate your retirement years, please reach out to us for assistance.