CONSERVE. PLAN. GROW.®

Minimizing (or Eliminating) IRMAA Medicare Surcharges

February 28, 2022

As with many transitions in life or business, a little advanced planning helps the process run much more smoothly. For investors in their 60s, a number of planning considerations come into sharper focus which means it is an especially important time for prudent planning. These considerations are varied and may include an exit or transition from a family business, planning for qualified retirement plan assets, pension or social security filing strategies, shifts with an investment strategy, or determining an optimal portfolio withdrawal strategy.

Another important decision point comes at age 65, which is the Medicare eligibility age. Healthcare expenses are a significant expense over the course of a full retirement period. Not only do healthcare expenses tend to rise as we age, healthcare costs also historically inflate at approximately twice the rate as core inflation. This, of course, makes healthcare planning a particularly important consideration over a full 30-year retirement period.

Fortunately, Medicare subsidizes a large portion of the cost for retirees who have contributed to Medicare throughout their careers. However, if your annual taxable income (for married filing jointly) is over $182,000 when you apply for Medicare, you could be subject to additional surcharges due to Medicare’s income-related monthly adjustment amount (IRMAA). The IRMAA surcharge is based entirely on your annual taxable income in the years leading up to retirement and during retirement.

In some cases, the IRMAA surtax can total more than $5,000 per year, and it’s applied in three-year intervals. Since many are winding down careers during this timeframe, it’s often when deferred compensation or other lump sum payouts are scheduled. These payments can not only unwittingly push you into a higher tax bracket, and also trigger additional costs like the IRMAA surcharge. Thus, it’s essential to understand how IRMAA works in order to minimize or even eliminate this cost as part of your retirement planning.

IRMAA Calculations

Medicare currently has 62 million beneficiaries, including approximately 4.3 million Americans who pay higher Medicare premiums due to their annual income exceeding the $182,000 (married filing jointly) threshold. It’s important to realize that your income from two years prior to applying for Medicare will be subject to IRMAA calculations to determine if you meet the criteria for the surtax.

The IRMAA calculation is based on a sliding scale and only applies to payments for Medicare Part B and Part D plans. The higher the beneficiary’s range of modified adjusted gross income (MAGI), the higher the IRMAA surcharge. High-income Medicare enrollees have been required to pay the IRMAA surcharge for Part B coverage since 2007. The IRMAA surcharge for Part D premiums officially took effect in 2011.

The standard Medicare Part B premium, which typically covers physician visits and a range of outpatient services, increased to $170.10 per month in 2022, marking a 15% increase from 2021’s monthly premium of $148.50. This jump is one of the biggest annual increases in the history of the Medicare program, which officially debuted in 1966.

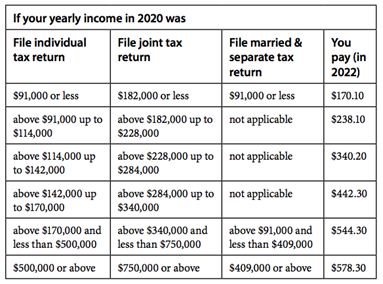

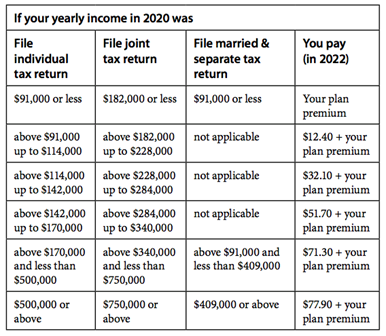

The tables below show the additional costs as they relate to filing status and income. Keep in mind that the standard monthly premium for Part B is $170.10, and that the costs below are applicable based on your Modified Adjusted Gross Income from two years prior.

MEDICARE - PART B

Source: Medicare.gov

MEDICARE - PART D

Source: Medicare.gov

With an annual taxable income of $182,000 or less (for married filing jointly), no surtax is applied. Income above that limit, but below $228,000, results in a combined Part B and Part D increase of an additional $964.80 annually. The next level of income, up to $284,000 annually for married filing jointly, doubles the standard premium for a combined surtax of $2,426.40 annually. The top income threshold, above $750,000 for married filing jointly, results in a $5,833.20 annual surtax.

When planning for the IRMAA surtax, we need to keep in mind that these surtaxes are assessed and charged for three-year periods. The IRMAA surcharge does not automatically “adjust” itself annually, so planning is essential.

Strategic Decisions

To avoid paying the IRMAA surtax, some investors can demonstrate a reduced income around the time of retirement that would put them in a lower taxable income level. For example, a business owner can decrease earned income by moving expenses forward or claiming deductions to lower annual taxable income. W-2 employees earning more than $200,000 should be mindful of income sources like stock options, equity payouts, annuities, or other income streams that may have some flexibility regarding when they are received. Scheduling payouts from deferred compensation programs is another factor that can impact IRMAA.

Depending upon your situation, it might be advantageous to file an IRMAA appeal and to request a manual review of your case. Using the Social Security Administration form 44, you can indicate that you've had a significant change in income and request that your IRMAA surcharge be recalculated. If your appeal is approved, your IRMAA surtax will be adjusted accordingly.

Ultimately, Medicare’s IRMAA surcharge is a retirement-related expense that you can prepare for long before your official retirement date. As always, we advise our clients to begin retirement planning as early as possible.

At The Fiduciary Group, we invite clients to speak with their investment advisor to explore the potential impact of the IRMAA surtax, and to evaluate mitigation options in the context of their broader financial plan. We realize that each investor’s situation is unique, and requires a customized, collaborative approach that takes personal goals and individual situations into account. As always, we are ready to guide you with data, market knowledge, and transparency to help you achieve your financial goals.

Please reach out to us for help navigating IRMAA surcharges and working towards retirement goals.