CONSERVE. PLAN. GROW.®

Market Commentary – A Fed in Transition

May 4, 2022

It has been a difficult start for the market in 2022 for both stocks and bonds. Certainly, a pause in performance wasn’t unexpected as the market has compounded at about 14% for the trailing three, five, and ten-year periods. We entered the year mindful of the risks of inflation on profit margins and valuation and with questions about the pace at which the Fed would tighten its monetary policies.

These concerns have been validated as inflation numbers have exceeded expectations, and the Fed has signaled a more hawkish approach. The Russian invasion of Ukraine has added another layer of uncertainty to the economy and the pricing of risk assets. Inflation fears have stoked recession fears which has resulted in stock and bond jitters. With market anxiety on the rise, we offer a few observations that may be helpful for investors to keep in mind.

Not a Good Start for the Year

It is not often that both stocks and bonds suffer negative returns in the same year. There have been only three instances since 1928 when the return on the S&P 500 and the 10-year US treasury note were both negative for the year with the most recent occurrence dating back more than 50 years to 1969 (coincident with the 1969-70 recession which lasted 11 months). Year-to-date through April 30, the S&P 500 has declined 12.9% while the 10-year US treasury note has declined 11.3% and the US Aggregate bond index is down 9.5%. Beneath the index level, the average stock in the S&P has experienced a 21% drawdown from its year-to-date high, while the average stock in the NASDAQ index is down 33% from its year-to-date high. These drawdown numbers place the individual stocks in bear market territory, even as the S&P has avoided being tagged with this designation to date. With this market backdrop, it’s easy to appreciate that investors are concerned and questioning their long-term strategic allocations to stocks and bonds.

U.S. Economy Growing, but So Is Inflation

Fiscal and monetary stimulus along with the post-Covid reopening have been a tremendous tailwind for consumers and businesses. The most recent first quarter GDP report showed business investment and consumer spending increased 9.2% and 2.7%, respectively. The strong economy has provided businesses and consumers with healthy balance sheets to sustain in a slowing economy, but they will undoubtedly face inflationary headwinds that may undermine profit margins and real wage growth. For now, businesses are reporting strong earnings and have the capacity to reinvest in their businesses, pay dividends, and repurchase shares. Consumers are similarly well heeled: the household debt service ratio (debt payments as a % of disposable income) stands at 9.3%, near multi-decade lows, and the labor force is fully employed with the unemployment rate of 3.6% at 50-year lows. Tight labor conditions, however, are one of the pain points for the Fed as wage growth has accelerated to a 6.7% annual rate, nearly matching the latest core inflation reading of 6.4%.

Financial Conditions Are Tightening

In response to rising inflation, the Fed is reversing a more than decade-long period of accommodation in which its balance sheet has ballooned from $1 trillion in 2008 to the current level of $9 trillion. At its recent March meeting the Fed laid out guidance to begin quantitative tightening at a pace of $95 billion per month as it seeks to withdraw excess liquidity from the financial system. In addition, the bond market is pricing in 250 basis points (2.5 percentage points) of rate hikes by year-end, a more rapid pace than was expected at the beginning of the year. In anticipation of Fed action, interest rates have increased across the Treasury yield curve, credit spreads have begun to widen, and mortgage rates have crossed the 5% threshold.

Consensus View More Bearish

Tighter financial conditions and recessionary fears have weighed on market sentiment as witnessed by the decline in stock and bond prices and increase in market volatility. According to data from Strategas Research, 87% of the trading days in 2022 have seen the S&P 500 trade in at least a 1% daily range, marking a noteworthy shift from the benign volatility environment observed throughout much of the quantitative easing era. The American Association of Individual Investors highlights a more bearish tone in the market as its recent survey reported that the share of bullish investors hit a 30-year low.

Valuation Levels More Attractive

We expect the tug of war between Fed tightening, rising rates, and the timing/severity of a potential economic slowdown may keep volatility elevated and continue to test investor conviction. Valuation multiples could remain under pressure so return expectations may need to be tempered as compared with the robust returns experienced during the last several years. Yet, valuation adjustments create opportunities for long-term investors, and higher interest rates produce more income for savers. Since the beginning of the year, valuation levels for both stocks and bonds have become more attractive as the forward price-earnings (P/E) multiple for the S&P 500 has declined from 22 times to 17.5 times, while the average yield of the US Aggregate bond index has improved from 1.75% to 3.5%.

Time in the Market Beats Timing the Market

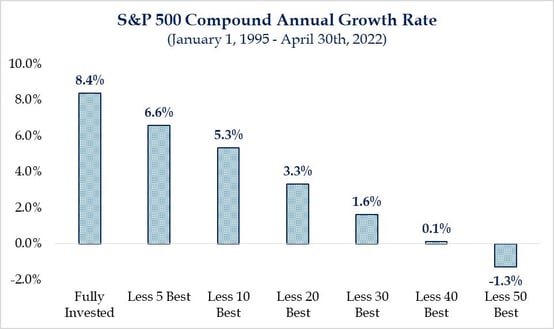

Source: Strategas

The above chart is a great reminder of the detrimental effect that market timing can have on returns. While declines in the equity markets can be unpleasant, staying the course is often the best approach as the best and worst performing days are difficult to predict.

During times of market volatility, many investors tend to shorten their investment time horizon without regard to their long-term financial goals. We empathize with the emotional difficulty of watching hard-earned savings decline in value during market drawdowns. However, compressing time horizons in response to current events can often lead to ill-timed changes to target asset allocations and poor market timing decisions. We endeavor to construct portfolios that balance your investment objectives with your risk tolerance, appreciating that no portfolio is immune from short-term headwinds. Maintaining a balance of equity and bonds has proven to be a successful way to help investors tolerate volatility while continuing to compound wealth over time.

Helping you stay the course and maintain a long-term perspective is part of our value add as advisors, and we encourage you to reach out to us anytime to discuss your investment strategy, progress toward your financial goals, and any questions or concerns you may have.