CONSERVE. PLAN. GROW.®

Since the birth of our nation, risk has been a fundamental component of our free market system. As fiduciary advisors, helping our clients prudently manage risks is a key part of our responsibility. The process of evaluating and managing risk is not a simple task, however, and over time various quantitative and qualitative tools have been developed to aid in the risk management process.

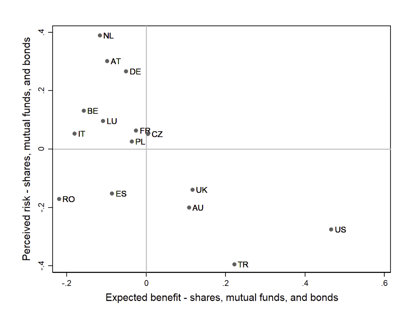

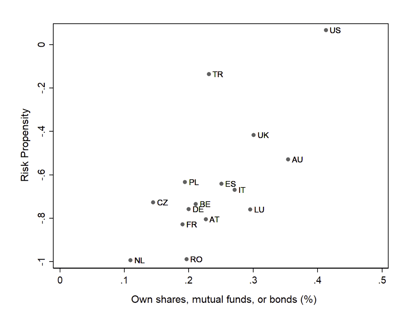

Historically, American investors have demonstrated a relatively higher risk tolerance than investors in many other nations. According to The Centre for Economic Policy Research, “The United States, Turkey, Australia, and the U.K. stand out as the countries where people tend to be subjectively more accepting of financial risks.”

In addition to Americans’ inclination to assume risk, the U.S. financial system offers a multitude of investment opportunities, allowing risk to be spread across a range of different assets and investment vehicles. The decline in prevalence of company managed pension plans and rise in individually managed retirement plans such as 401(k)s has also led to a greater percentage of Americans who participate directly in the public investment markets. In fact, a survey completed by the Federal Reserve reports that 53% of U.S. families owned publicly traded stock in 2019, compared with just 32% in 1989. More recent data from 2023 show the percentage is now above 60%.

U.S. investors tend to be less risk-averse compared to other industrialized nations

Source: The Centre for Economic Policy Research

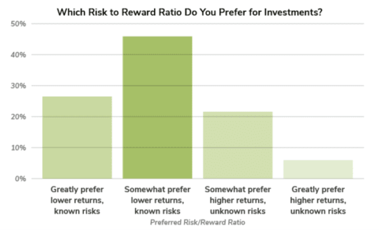

While there is no denying that, in general, our society embraces risk-taking as a pathway to wealth and success, individual investor’s risk tolerance can vary widely. The tendency to embrace or to avoid risk is based on a variety of factors, including an investor’s goals, overall risk tolerance, the latest news headlines, as well as market conditions. Aligning a long-term investment strategy with an investor’s own risk profile is critical for long-term success.

Understanding Risk

What exactly is risk? In investing terms, standard deviation is a common mathematical definition of risk. Standard deviation is a formula which measures how widely the return of an investment varies from its average or expected return. A higher standard deviation indicates greater variability and risk, as returns are more likely to fluctuate widely from the mean. Conversely, a lower standard deviation signifies less variability and lower risk, suggesting more stable and predictable returns. Investors use this measure to assess risk in several aspects of the portfolio construction process.

While the variability of an investment's return around its mean is certainly a valuable input, it only captures one narrow aspect of risk. In addition to variability risk captured by standard deviation, credit risk, inflation risk, interest rate risk, among many other types of risks, are also important investment risk considerations. More broadly, investors must consider risk factors relevant to their overall financial plan and not just at the security level. The risk of a down year in the markets at an inopportune time, the risk of encountering diminished mental capacity or other health challenges, and the risk that significant business or real estate holdings become impaired are all factors which could have an outsized impact on our financial lives. Standard deviation, then, is a helpful tool to frame some risks but is far from comprehensive.

It’s impossible to eliminate all risk from our lives and from our investment portfolios. The reality is that we take risks every day. We drive cars and travel on airplanes; we cross busy streets; we eat food prepared by others. These are all “normal,” everyday activities that carry some inherent risk. When it comes to managing financial risks, the process starts by developing a thorough inventory of assets, liabilities, and key components of cash flows. The organization of this data in a thorough but digestible format enables a diligent assessment of risks and possible mitigation strategies. It’s important to evaluate financial planning from a quantitative perspective, but it's also critical to have a plan that aligns with your overall risk tolerance, which should take into account more subjective risk factors as well.

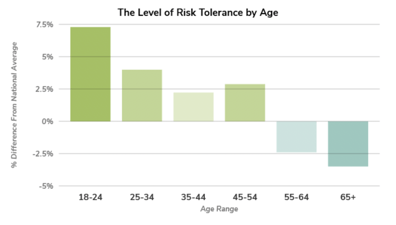

Age and personal preference are often leading factors in risk-taking.

Source: coventrydirect.com

Risk Tolerance

Generally speaking, risk tolerance refers to the level of risk an investor is willing to take. There's a human tendency to protect against risk, and this tendency often becomes more pronounced as we age. That’s why it’s important to assess your individual risk tolerance in concert with the development of a financial plan and investment strategy. Investors should also revisit risk over time, as significant life events can impact risk tolerance.

There are two main factors involved in how we assess risk tolerance: the ability and willingness to take on risk. An investor’s ability to take on risk can be well understood by running the numbers. Understanding a client's broader financial picture and the expected demands on investment assets over time help determine what level of risk can be applied to portfolio assets while still maintaining a high degree of confidence in ultimate outcomes. Based on statistical analysis, we can determine a certain range of portfolios that will be sufficient to help a client achieve their goals.

As advisors, we run models to better understand expected outcomes and the role a portfolio will play in the larger context of a client's financial life. We analyze worse than expected “stress test” scenarios to better understand the risks which can have the most significant impact on your finances. An investor’s ability to assume risk is based on analysis, data, and math.

An investor’s willingness to take on risk, on the other hand, is much more subjective and tends to be based on life experiences, personality, age, and other factors. Although an investor's willingness to take risks is partly based on inherent personality, external factors often play a big role as well. For example, we have worked with many families who have taken significant professional and financial risks throughout a business career, and upon liquidating their business, place a much greater emphasis on safety and security. For these clients encountering significant life-changing events, taking time to methodically take stock of their situation, their future needs and goals, and what life looks like post-sale help to promote a sensible approach to risk management.

Having honest conversations with your advisor about your personal risk tolerance, and thoughtfully balancing your willingness to take risks with your ability to take risks is key for long-term success. We find that a thorough assessment of risk at the outset of the investment process also leads to greater resolve to stick with an investment plan through the inevitable swings of the markets. Ultimately, a sound approach to risk management strikes a balance between growth, capital preservation, and a "sleep well at night" peace of mind.

At The Fiduciary Group, we believe that helping clients strike the right balance of risk is among the most important parts of our commitment to clients. If we can be helpful to you in reviewing your own risk tolerance, please contact us. We’re here to help.