CONSERVE. PLAN. GROW.®

How Presidential Elections Can Affect the Stock Market

April 3, 2024

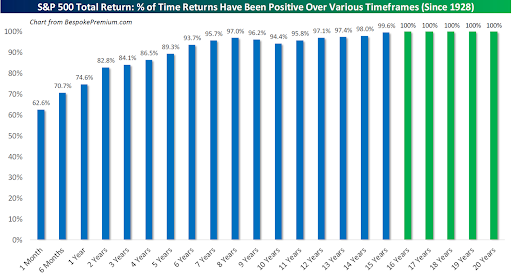

Election season is upon us, and one of the most frequent questions our team gets asked is, “How will the 2024 presidential election results affect markets?” While we appreciate that elections are emotionally charged events, it is important to remember that an investment portfolio is a long-term proposition. Time is your friend, both in terms of your perspective on current events and actual portfolio returns. While we always preach ‘stay the course’, that is only to stack the probabilities of success in your favor. As shown in the chart below, the probability of markets being positive over rolling-periods increases with each year your time horizon increases.

Time is on the Investor’s Side

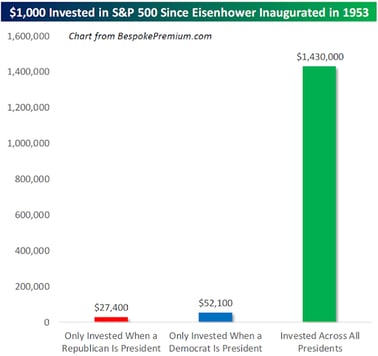

There’s additional data which should help keep investor emotions in check. Market timing, based on which party has won the presidency, hasn’t worked as compared with being invested across all parties. The results of only investing when a Republican is president (4.2%), or only when a Democrat is president (5.1%) have been dismal compared with staying invested across parties (9.5%) (since 1953 as detailed in the chart below). While this data set seems extreme, it does drive home the importance of ensuring your portfolio compounds over a long-period of time. Adjusting your risk appetite as a result of short-term emotion can prove very costly in the long-run.

Don’t time investments according to political party

There are three branches of government, two of which are required to pass legislation into law. The executive is one piece, and historically, checks and balances from the other branches water down one’s worst fears or best hopes when it comes to passing legislation. This effect of greater relative legislative stability tends to bode well for companies. While particular industries may be more acutely impacted than another depending on the agenda of who’s in office, it’s important to remember that CEOs must grow their businesses and satisfy shareholders, regardless of whether a Republican or a Democrat serves as President. Apple will still work to increase its valuation despite changing tax codes and regulations. Coca-Cola will still try to sell more soda and gain market share, no matter the political climate. Tesla will continue to push electric vehicles, with or without federal subsidies.

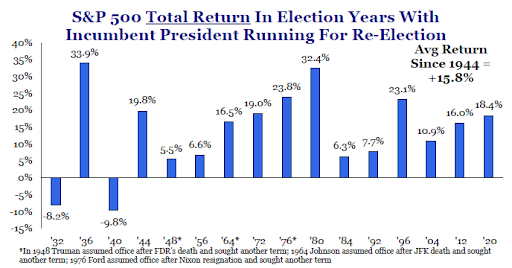

Markets tend to perform well during re-election cycles. Officials up for re-election, in particular the President, want their electorate to have confidence that they are doing everything they can to positively affect economic conditions. Fiscal stimulus tends to be plentiful during the re-election cycle in an attempt to drive this narrative. Markets know this and tend to have positive outcomes during Presidential re-election years as seen below.

S&P 500 Total Return In Election Years With Incumbent President Running For Re-Election

The outcome of the November election may be unknown, but it’s important to ignore hyperbolic claims of apocalyptic disaster, like “it’s all over if ______ wins!”. Remember, news organizations have a 24-hour cycle to fill with content, and know that whipping up commentary about presidential candidates translates into higher ratings and more clicks.

Numbers don’t lie, and the vast majority of data we have over dozens of presidential election cycles tells us that investors need not panic. Time and time again, if the market overreacts to politics, reality quickly catches up and restores order. Some policies will have positive effects, some negative, and small, short-term swings as a reaction are normal. Any expectation of imminent catastrophe if one presidential candidate triumphs over another candidate is not.

At The Fiduciary Group, we remain focused on generating attractive, risk-adjusted returns for our clients over the long run. We do not know what the stock market will do in the short-term, but we do have a high degree of confidence in the returns offered by long-term equity ownership.

If you have questions or concerns about the election or any financial issues, we invite you to reach out to us to have a conversation. We stand by, ready to help you build and manage your wealth over time and through a wide range of political and economic conditions. We are here to help you plan for the future, so feel free to reach out to us for assistance at any point.