CONSERVE. PLAN. GROW.®

Considerations For Investing in Bonds

July 1, 2022

When many people think about investing, their minds immediately go to the stock market. However, the bond market is the largest securities market in the world, representing over $100 trillion of debt. The most common bonds include government, corporate, municipal, and asset-backed securities (where cash flows from mortgages, credit cards, and car payments are bundled together to create a bond). Purchasing bonds can be an effective solution for conservatively investing capital relative to less predictable asset classes such as stocks, real estate, and commodities.

Most Americans have borrowed money to fund a purchase at one point or another. For example, we are willing to pay interest to obtain housing, automobiles, and education. Governments, municipalities, and corporations also frequently borrow money to fund their spending initiatives. When an entity is seeking capital to support spending, issuing a bond is often an option considered. Investors who purchase the bond are the lenders and are contractually obligated to receive interest payments (referred to as coupons) for a defined period and expect to receive the bond's face value when the bond reaches maturity. The predetermined timing of cash flows and yield received for the investment are attractive characteristics, particularly in uncertain and volatile economic times.

Understanding Risk

Credit risk and interest rate risk are the primary factors when analyzing a bond. Any lender wants to have confidence that the borrower can meet the loan terms. The certainty level of loan repayment is a significant determinant in the pricing of the bond. Corporations with sound, solid balance sheets will have lower capital costs and thus offer lower yields than companies with more uncertain financial prospects. When a corporate bond is issued, it is priced relative to a comparable length U.S. Treasury Bond, which is the safest bond available. The yield over the Treasury Bond is known as the "credit spread." The higher the credit spread, the riskier the market views the bond.

As investors, we spend time looking for opportunities that represent value and perform fundamental financial analysis to identify bonds that are priced attractively from a risk/return perspective. Finding issuers with minimal risk of not being able to make payments is of the utmost importance, but sometimes the market perceives the risk of missing payments to be higher than we believe to be the case. If we are correct, those bonds offer incremental yield in the form of a "credit spread."

Interest rate risk is the risk that interest rates rise. When interest rates increase, existing bonds decline in price because the coupon of the outstanding bond is no longer competitive with the rate offered on new issuances. Bond prices fell in the first half of 2022 due to rising interest rates. Historically, inflation and interest rate movements have moved in tandem, which has also been the case this year. The expected return of the existing bonds has not changed (if held to maturity), but now there are more attractive bonds than previously issued ones.

Short-Term vs. Long-Term Bonds

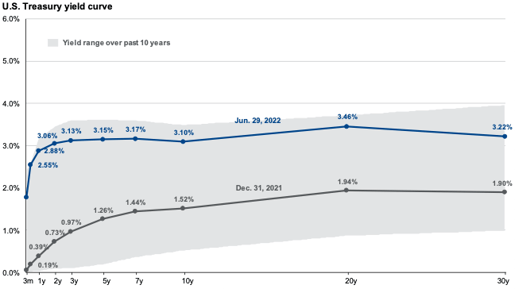

Shorter-term bonds inherently have less interest rate risk. Even if rates rise, the bond will soon mature, and then there is an opportunity to invest the proceeds in a bond offering those higher rates. Therefore, longer-term bonds typically require a higher yield due to the increased sensitivity to interest rates, known as the "term premium," and can be observed in the shape of the "Yield Curve." As you can see below, the shape of the yield curve is relatively flat right now, especially compared to where we began the year. One conclusion from the "flat" structure of the current yield curve is that buying a longer-term bond at current rates provides little compensation for increasing exposure to interest rate risk.

Source: FactSet, Federal Reserve, J.P. Morgan Asset Management. Guide to the Markets – U.S. Data are as of June 29, 2022.

Forecasting interest rate movements is challenging as they are subject to numerous macroeconomic variables and government policy decisions. To reduce portfolio bond volatility, we tend to be structurally invested in shorter-term bonds (with a lower duration) relative to the Aggregate Bond Index. We are more comfortable analyzing businesses and taking on reasonable credit risk to earn higher yields.

In today’s economic climate, bonds continue to be a meaningful component of investment portfolios. While returns for bonds have been disappointing to start the year, higher interest rates mean bonds have become more attractive going forward. We are encouraged as we see promising opportunities to invest capital in bonds for the conservative portion of portfolios and will continue working to balance credit and interest rate risk properly with the expected return. We are careful not to introduce unnecessary risk into the bond portion of portfolios, as equity investments should drive the portfolio growth over time while bonds provide stability.

If you want to learn more about bonds or have questions about your investment portfolio, please reach out to us to get started.