CONSERVE. PLAN. GROW.®

Countering Volatility with Counterintuitive Action

April 12, 2017

My mom asked me once how I swallowed pills. “Show me,” she said. I went through the motions of pretending to put a pill in my mouth, mimed the act of taking a sip of water, then leaned my head back and swallowed. “That’s exactly the opposite of what you should do,” she said. “Instead of leaning your head back, you should take a sip of water, tilt your chin forward, then swallow.”

Having since swallowed many large vitamins the way she instructed, I can tell you, Mom was right. It may seem counterintuitive, but tilting your chin forward rather than leaning your head back makes pills go down a lot easier. I even did a bit of research on this and learned that a study at the University of Heidelberg in Germany found an 89% improvement rate in swallowing when subjects used the “lean forward” technique.

By now you may be asking, “what does this possibly have to do with investing, other than the fact that volatility in an investment portfolio (particularly declines in value) can be a hard pill to swallow?” Here’s the relevance. When faced with volatility in portfolio values, people often do exactly the opposite of what they should do. When values go up, people start feeling better about the “market” and start investing in or increasing their allocation to stocks. When values go down, people get scared and seek to “get out.” But what human instincts tell us to do is exactly the opposite of what we should do: buy low and sell high. My takeaway is that smart investing is counterintuitive. It takes a strategy and an effective implementation technique to be successful.

If success in investing is defined as achieving your financial objectives, there are two techniques in the Investing 101 Toolkit to improve your success rate: (1) proper asset allocation; and (2) disciplined rebalancing.

Proper Asset Allocation

For purposes of this discussion, “asset allocation” refers to the relative portion of a portfolio an investor allocates to each of the three major asset classes—stocks, bonds, and cash. A “proper” allocation means that an investor’s exposure to each of the asset classes is “right-sized” relative to the investor’s objectives for the account, time horizon for liquidating the assets, and personal tolerance to the level of volatility risk that such an allocation strategy entails.

I intentionally use the words “volatility risk,” and not “risk of loss” for a reason. “Volatility risk” in this context refers to the range of changes—up or down—in the value of an asset (or range of deviation in the average return). The price of an asset that is highly volatile can change dramatically in either direction over a short period of time. Volatility risk only becomes a risk of loss when one sells (liquidates) the assets when values are down. This is why an investor’s time horizon for liquidating a financial asset is so important relative to the investor’s capacity to withstand volatility risk.

Cash is the least volatile of the 3 asset classes. Cash or cash equivalents (Money Market accounts, CDs, US Treasury Bills, and other short-term instruments with a duration of 3-months or less) generate no or low returns, but are not subject to material changes in valuation. The level of cash which one should keep in an investment account depends on one’s need for cash to cover near-term expenses. If you plan to distribute money from an investment account in the next 6 to 12 months to cover living expenses, make a large purchase, or pay a child’s college tuition, it is prudent to keep those funds in a cash equivalent investment which will not materially change in value. Though you won’t earn much if anything on the investment, at least you know the money will be there when you need it and will not drop in value in the meantime.

Bonds are more volatile than cash but less volatile than stocks. Price volatility in bonds depends on the duration of the bond (how many years until the bond matures) and credit risk. The longer the duration and the riskier the creditworthiness of the bond issuer, the higher the volatility. A balanced, well-diversified bond portfolio should generate modest returns with a small to moderate risk of volatility. For investors who plan to liquidate assets and distribute the cash within a 5-year horizon, bonds are a sensible investment.

Stocks are the most volatile of the 3 asset classes, but also are expected to produce the highest average annualized returns over the long-term. Stocks are an appropriate asset in which to invest funds that you don’t plan to use for 5+ years because if there is a dramatic decline in the value of the stock portfolio, you will want time to ride out the recovery. You don’t want to be forced to sell out of stocks when the value is down.

Take the example of the dramatic decline in the stock market in 2008. An investor who bought an S&P 500 index fund at the start of the year would have seen the value of his/her investment drop by 38% by year-end (intra-year, the large-cap index declined 49%). However, if that investor held on to the stocks for the next five years, he/she would have earned average annual returns of about 18%. Seen from an even longer-term perspective, the 10-year annualized return at the end of 2013 was 7.41%. Despite big swings in valuation during that decade, the investor who remained invested in the large-cap index would have earned an average 7.41% compounded annual return from the start of 2004 through 2013.

Now back to the notion of what constitutes a “proper” allocation. From my perspective as a financial planner, the starting point is the investor’s time horizon, which is the biggest determinant of an investor’s capacity to handle volatility risk. The first question I ask is “what are your distribution needs from this portfolio over the next 12 months, in the next 1 to 5 years after that, and 5 years and beyond?” The starting “base case” would be to allocate 12 months of planned distributions to cash equivalents, the next 5 years of planned distributions to bonds, and the balance to stocks. For example, if planned yearly distributions were 5% of the account value, the “base case” allocation would be 5% cash, 25% bonds, and 70% stocks.

After establishing the base case, I layer in other factors that address the investor’s “tolerance” for volatility risk. These factors include:

- The investor’s personal/ emotional tolerance for swings in portfolio value. I try to determine how much of a decline in portfolio value the investor can handle psychologically before he/she wants to “throw in the towel” and sell out.

- The investor’s primary objective for the account. My goal here is to determine what is most important to the investor—preservation of capital; generation of income; growth of principal; or balance between income generation and growth of capital.

- The investor’s return expectations. This is where I explore how much the investor needs the account to earn on an annualized basis in order to meet the investor’s goals. I also try to determine whether the investor’s return expectations are in line with both the expected return of the allocation strategy and his/her risk tolerance.

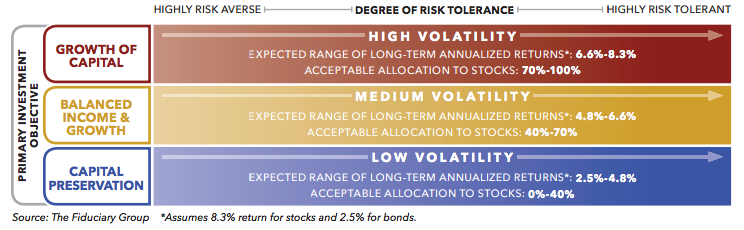

The final allocation strategy is based off of the percentage of the portfolio allocated to stocks, as the stock component is the biggest driver of both expected return and price volatility of the portfolio. The chart below shows the relationship between primary investment objective, investor risk tolerance, return expectations, portfolio volatility risk, and stock allocation ranges. Where an investor falls within the range of appropriate stock allocations for any given strategy depends on the investor’s tolerance for volatility risk.

The Counterintuitive Art of Rebalancing

The final piece of the puzzle is rebalancing. This means periodically returning to the chosen strategic allocation targets. It’s best explained by example. Let’s assume that a retired couple living off the income produced by their investment portfolio has decided on a balanced 60/40 strategy (60% stocks, 35% bonds, 5% cash). This is a reasonably moderate Balanced strategy in that the cash covers 12+ months of living expenses, the bonds cover the next 7 years of living expenses, and the stocks cover living expenses for 7+ years and beyond, appropriate time horizons for these asset classes.

Let’s assume the stock market pulls back and the bond market has gains. The portion of the portfolio that was allocated to stocks is now something less than 60% because the values of stocks have fallen. The bond portion is larger than 35% because those values have grown. By rebalancing to the original targets (60% stocks, 35% bonds, 5% cash), we buy more of what has not been working (stocks) and sell what has been working (bonds). This is smart investing—buying low (stocks) and selling high (bonds).

Simply put, rebalancing to a thoughtfully chosen allocation strategy is a disciplined way to swallow easier the pill of volatility.